In response to the dramatic repercussions of COVID-19, governments are seeking to pursue economic recovery from the global pandemic by adopting tax and fiscal policy responses. Fiscal stimulus measures, support for companies to preserve employment, state guarantees for loans and other liquidity incentives have been provided in order to mitigate the pandemic’s impact on their citizens and their economies. Adapting fiscal and monetary policies to the emerging challenges can save peoples’ lives, prevent high unemployment rates and avoid a drop in incomes levels as well as company bankruptcies.

Unprecedented burdens on world economies

With more room to maneuver, advanced economies have succeeded in ensuring a much greater fiscal response than developing countries whose reliance on tax revenue is significantly higher. OECD’s data points to more than 700 emergency tax and fiscal policy measures having been introduced by over 100 countries in response to the crisis. Seeking economic recovery, governments have introduced a large variety of fiscal packages oriented towards tackling the immediate impact of the crisis on businesses and households. The measures intended to enable businesses to stay afloat have been more or less similar across different countries with a strong focus on tax payment deferrals while measures to support households are more specific to each region and its frameworks.

Alleviating the sharp decline in liquidity and related repercussions for businesses

Many support measures seek to avoid difficulties such as laying-off of employees, the inability to pay suppliers or creditors and the prospect of bankruptcy. Providing companies with sufficient cash flow has become an imperative since cash flow issues can quickly trigger the failure of multiple connected businesses. The OECD report regarding tax and fiscal policies in response to the coronavirus crisis reveals that around half of those measures reported by countries have been oriented to providing adequate cash flow to businesses.

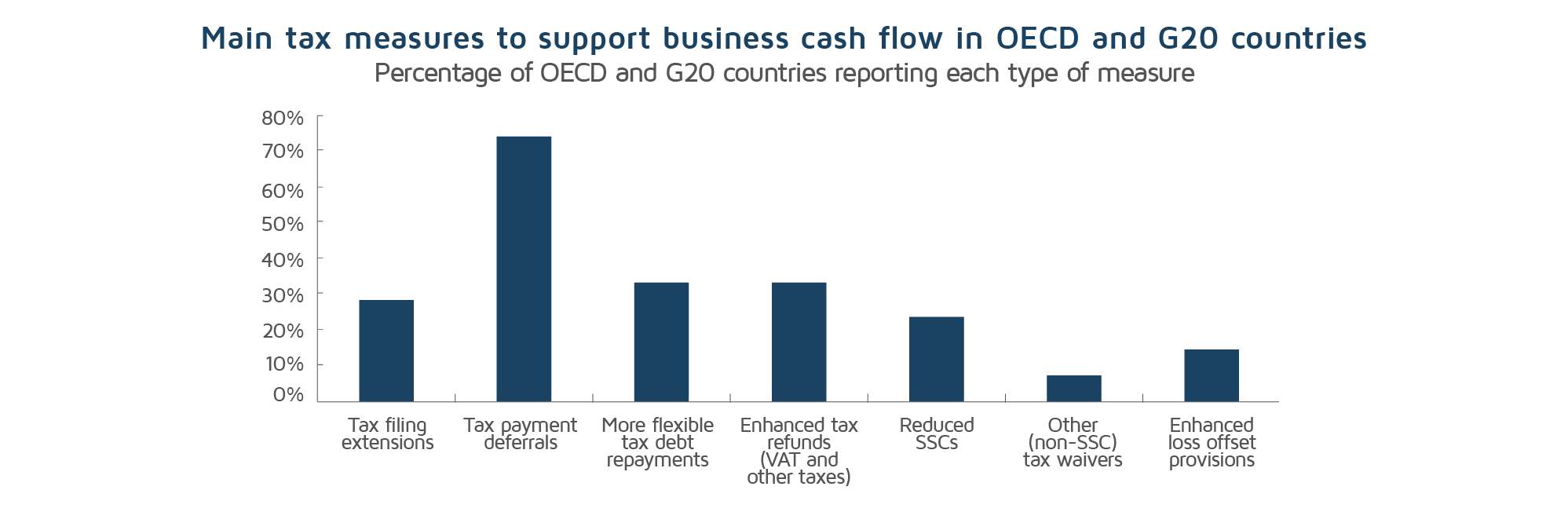

The OECD and G20 governments have guaranteed all or part of the value of bank loans granted to eligible businesses. Small interest-free loans and cash grant schemes have targeted businesses in the most affected sectors. Three quarters of OECD and G20 countries have implemented the deferral of tax payments such as corporate income tax (CIT), personal income tax (PIT), value added tax (VAT) and social security contributions (SSCs). Around 30% of OECD and G20 countries have also provided companies with additional time to file tax returns and more flexible tax debt repayment plans.

Extensions to tax filing deadlines and more flexible tax debt repayment schedules are common measures that have been adopted by non-OECD, non-G20 and developing economies as well. Tax payment deferrals accounted for around 45% of the total number of measures reported by these economies.

Some countries have been focused towards addressing the repercussions suffered by companies in the most affected sectors. Others have targeted their efforts on cushioning the economic drop registered by small and medium sized enterprises (SMEs) or self-employed businesses as it is expected that these companies will face a more significant decline in liquidity than others.

Helping businesses to retain their workers

By developing or extending short-time work compensation schemes, governments have enabled businesses to cut working hours rather than sack staff. Employees whose working hours have been reduced or who have been temporarily laid off have received additional income support designed to compensate for any financial loss. The German practice of short-time work has been presented as a model crisis response, shown to be capable of limiting the damaging effects of the pandemic.

In their efforts to mitigate coronavirus devastating repercussions on employment, more than half a million businesses in Germany have succeeded in reducing their costs by lessening the regular working time. Thus, they have maintained their workforce and avoided layoffs. The Federal Employment Agency is covering up to 60% or 67% for employees with children of the net loss in remuneration.

While OECD and G-20 countries have succeeded in expanding short-time work schemes, developing economies cannot capitalize on such policies due to the high costs and a lack of experience in implementing various wage subsidies for employers. However, there are some exceptions such as Peru, whose government announced a wage subsidy for employers equal to 35% of the salaries for workers with a gross monthly income of less than US$430.

Oriented to support the most vulnerable households

Taking into consideration the severe nature of the crisis, many OECD and G20 countries have expanded their existing protection policies to reach a greater number of beneficiaries and have simplified the access to social incentives. Governments are therefore providing income replacement for households affected by sickness, unemployment or a drop in income. Most countries have chosen to provide financial support through direct transfers rather than through the tax system as these can be processed more quickly and help is easier to target. It would be more difficult to distribute support through the tax system due to the high level of informal economies which mean that many businesses with do not pay or underpay taxes. Therefore, the deferral of tax payments or quicker tax refunds do not represent a viable solution in the context of this crisis.

Less room to act for developing countries

More than a third of OECD and G20 countries have expanded the payment of unemployment benefits to cover part-time or self-employed workers, those less protected against a loss of income. Chile has offered incentives to people without formal work which accounts for around two million beneficiaries. Countries such as Italy, Lithuania and the United Kingdom have focused on addressing the loss of earnings for those who are self-employed.

Outside the OECD and G-20, cash payments have been made to vulnerable households in Kenya and to low-income households in Peru. Emerging markets and developing countries have chosen to ensure the payment of income support to households rather than increasing social protection policies and unemployment benefits. Malawi, one of the world’s poorest countries, announced an emergency cash transfer programme aimed to cover the needs of more than 170,000 households. Another 270,000 vulnerable households and people who recently have lost their source of income in Jordan will receive cash support. The World Bank decided to provide $374 million to be distributed to Jordanian households.

More significant fiscal packages have been provided in countries suffering a higher incidence of the pandemic where the economic impact could be more severe and require a stronger fiscal response. While the global crisis persists, several existing measures could be extended, adjusted to the new challenges, new policies to mitigate the stark consequences could be introduced.

Subscribe to DevelopmentAid news and track the most relevant information in the international development sector.