In 2019, the Swiss government announced that it would narrow the focus of its international development strategy to promote greater effectiveness. The newly proposed strategy for 2021-2024 was approved by the Swiss Parliament in early 2020, after it has undergone a series of public consultations. The effectiveness driven strategy defines four thematic pillars of future Swiss aid – job creation, climate change mitigation, irregular migration and forced displacement and the promotion of peace and the rule of law. The Swiss Investment Fund for Emerging Markets, a Development Finance Institution founded by the Swiss Government and an important element of the country’s development architecture, has increasingly invested in climate financing. In this article, part of the ‘DFI files’ series, DevelopmentAid profiles the Swiss Investment Fund for Emerging Markets and explores its growing role in climate financing.

One of the smallest DFIs in Europe in terms of total commitments (with US$70 million new investment commitments in 2018 and US$958.1 million total commitments to date), SIFEM has, since 2005, contributed to an inclusive growth in emerging markets. Owned by the Swiss government, the institution has been an integral part of the country’s mechanisms for economic development abroad. SIFEM specializes in providing long-term financing to small and medium-sized enterprises (SME) and other fast-growing companies in developing and emerging countries, focusing on the priority countries of Switzerland’s development cooperation. SIFEM channels its investment portfolio primarily through private equity or debt funds which target SMEs. The portfolio consists of 64% of private equity funds, 11% of investments by other financial intermediaries and 17% of current income funds. As of more recently, the institution has taken upon investing in sector specific funds in a broad range of areas such as renewable energy and energy efficiency, resource management and sustainable forestry.

SIFEM prides itself with sustainable job creation

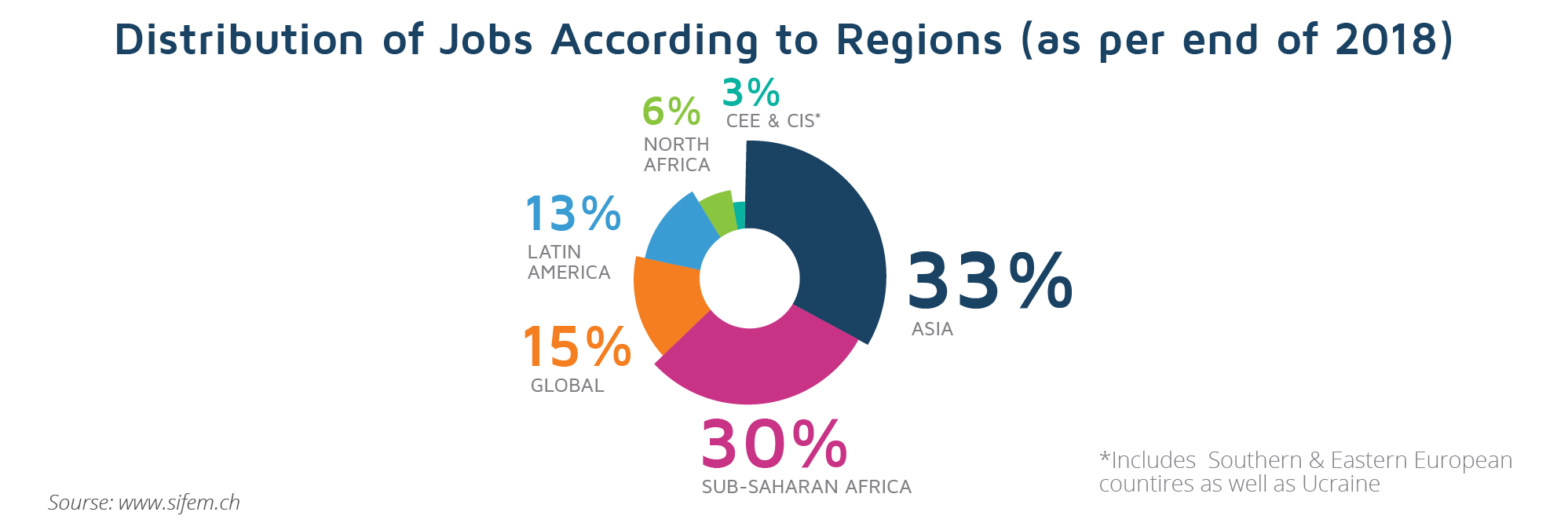

At its core, SIFEM’s work focuses on expanding and strengthening local entrepreneurship in emerging markets. SIFEM’s activity report for 2018 shows a staggering statistic in that, together with co-investors, since 2005 it has created and supported more than 830,000 jobs of which 40% of the employees in SIFEM portfolio companies were women, a share which has been increasing over recent years. The leading region in the job creation portfolio is Asia, with 33%, followed closely by Sub-Saharan Africa, Latin America, North Africa, Central and Eastern Europe and CIS. Employment in the portfolio grew by 8% in 2018, SIFEM having engaged in eight new investments totaling US$70 million, with Asia continuing to lead since India was the largest recipient of investments with more than 54 companies receiving financial support.

Besides more jobs, SIFEM has committed itself to creating better jobs. Since 2017, SIFEM has required that managers of the funds that it invests in set occupational, health and safety targets that exceed relevant local regulations. Health and safety in the workplace are important components of what constitutes quality jobs – decent work is safe work. In 2018, SIFEM invested in six funds which have all committed to report year-on-year occupational, health and safety targets for their respective portfolio companies. For instance, one fund set a target of a zero-accident rate while, in another case, the target was defined in terms of the minimum number of safety inspections per month and the percentage of safety recommendations implemented. Moreover, all SIFEM investments must comply with international standards in environmental, social and corporate governance (ESG).

Playing a niche role in climate financing

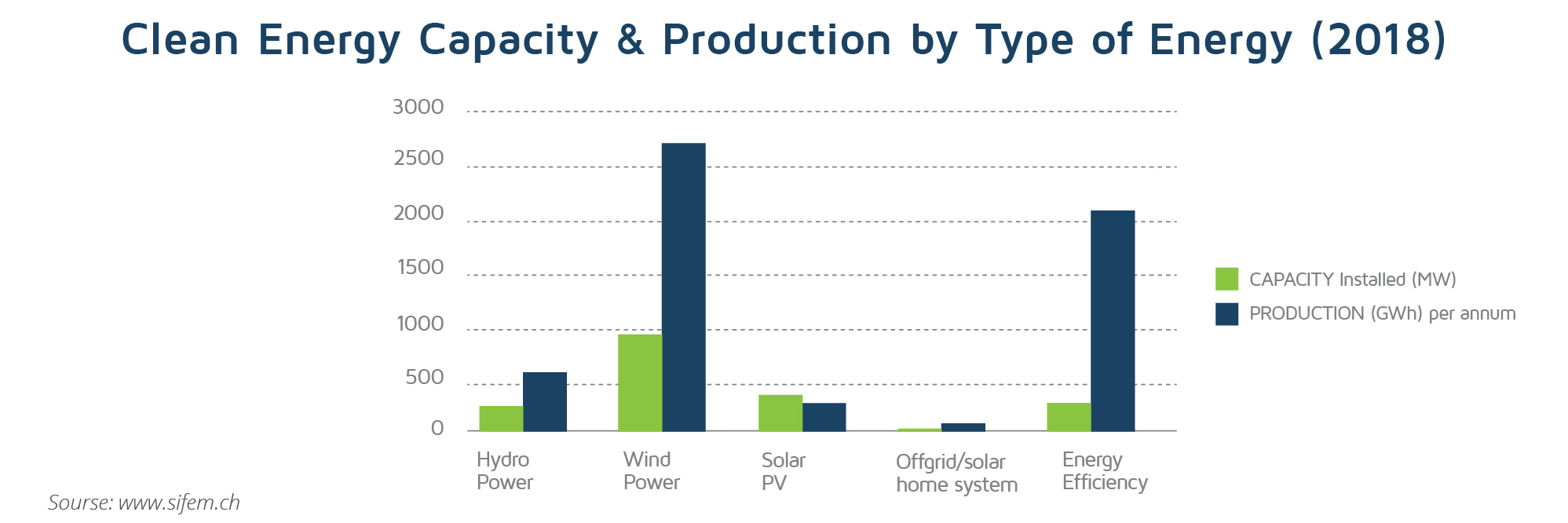

Climate change mitigation is a priority area for the Swiss government and it will continue to take even more precedence with the narrowing of the focus of the new 2021-2024 development strategy. SIFEM plays a niche role in climate financing, working with companies with disruptive or innovative business models in the area of renewable energy, as well as in energy efficiency solutions for SMEs. During the period of 2008 to 2018, SIFEM’s cumulative financial commitments to 12 climate-related investments amounted to US$120 million. This represents 13% of SIFEM’s cumulative historical commitments (since 2005) of US$958 million. These 12 investments are concentrated in two climate mitigating sectors – 86% in renewable energy and energy efficiency, contributing towards the fulfilment of SDG 7, and 14% in sustainable forestry directed towards fulfilment of SDG 15. In 2018 alone, SIFEM, together with investment partners, produced 5,470 GWh of clean energy and avoided 6.1 million tons of CO2 emissions.

In the period 2017-2018, SIFEM invested in three new climate-relevant investments (African Forestry Fund II, Frontier Energy II and South Asia Growth Fund II) with a total commitment of US$27 million. In this context, SIFEM utilized directly and indirectly around US$6 million of the total amount of US$60 million of private capital deployed by Switzerland for climate-relevant activities. The last round of investment, the South Asia Growth Fund II, was made together with seven other European DFIs which have cumulatively invested US$115 million. The 10-year investment fund will invest in businesses that promote cleaner sources of energy and industrial production, efficient unitization of energy and materials and sustainable management of natural resources in South Asia. The largest share of the fund will go to India, although the entity will also invest in companies in Bangladesh.

An impact investor

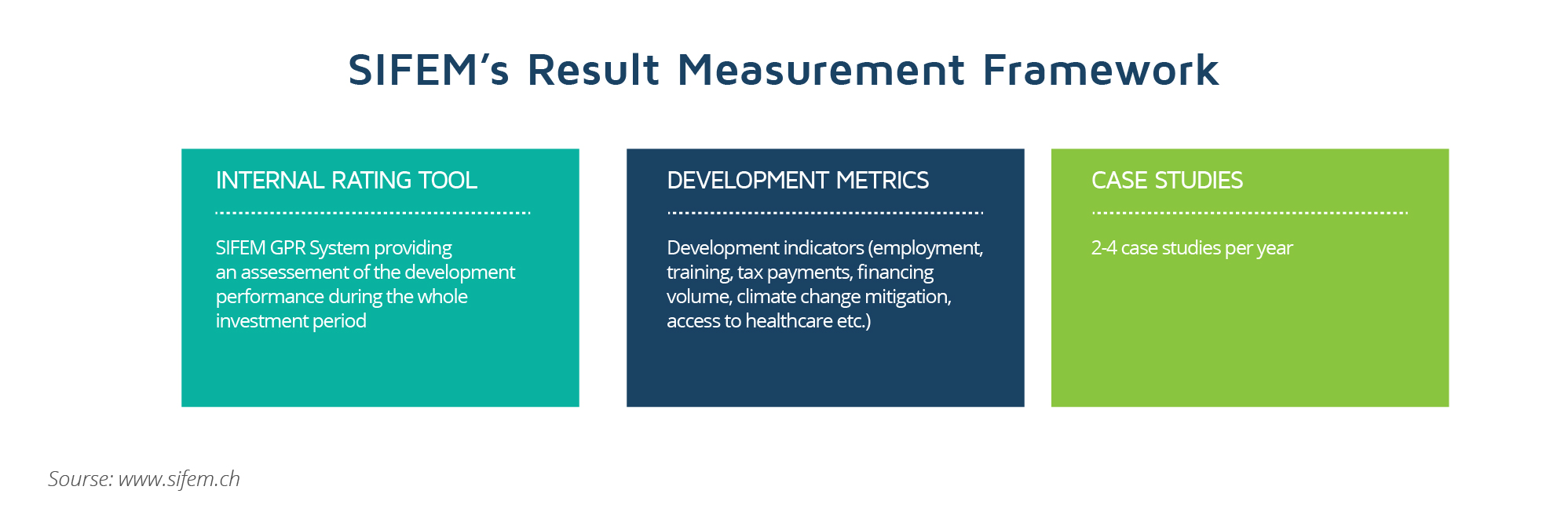

SIFEM highlights its status of being an impact investor whereby each investment is made with the intent of generating a measurable development impact. The institution uses a results measurement system that is in line with the practice of other DFIs which allows for comparative monitoring and aggregated results.

Since January 2018, SIFEM has been using an ‘Impact Policy’- a methodology directed towards maximizing the development effects throughout the whole investment cycle. For this purpose, SIFEM analyses and monitors the contribution of its investments against four broad development pillars which are fully aligned with the 2030 Agenda for Sustainable Development and with the strategic objectives assigned to SIFEM by the Swiss Government for the period 2018-2020. At the core of SIFEM’s interventions stand the two most significant pillars – economic viability and economic development. SIFEM investments also hope to contribute to Social Inclusion and Global Public Goods and Challenges.

This article is part of DevelopmentAid’s “DFI files” series where detailed accounts of European and North American DFI activities are available. You can Become a member and Register for our newsletter to stay tuned to the next DFI files, Norway’s DFI, Norfund.