Financial aid is a component of Official Development Assistance provided by governments to accelerate change in developing countries and includes grants, loans, and other financial flows. While grants are non-refundable resources intended to finance development activities in recipient countries, loans refer to repayable financial transfers often conditional on certain outcomes such as internal policy reforms. This article provides an overview of financial aid, grants, and loans in the context of international development and cooperation.

What is financial aid?

Financial aid represents the voluntary transfer of capital from a country or an international organization to a developing country with the objective of reducing poverty, achieving sustainable development, or strengthening human development. The Organization for Economic Co-operation and Development (OECD) which is one of the key actors in monitoring the flows of bilateral aid, views financial aid as a part of Official Development Assistance (ODA) which may include grants, loans, and other financial flows.

See also: Foreign aid and top donor countries in 2020

What are grants?

A grant is defined as a form of financial assistance awarded to a developing country or a third-party beneficiary (e.g., a domestic NGO, NPO) with no obligation for repayment. Grants are intended to finance specific policy or development activities and the results of the actions undertaken remain the property of the beneficiary country. In order to be considered as a potential grant recipient, applicants must fit the eligibility criteria and are required to submit a proposal to the contracting authority within a designated time frame. In the case of the European Union, the largest international donor, grants are governed by the following principles*:

* There are a number of exceptions to these principles which can be found here

It is important to note that grants can be managed (i) directly meaning that the funding agencies (e.g., the European Commission) will be solely responsible for the entire award procedure or (ii) indirectly, meaning that a third party (e.g., a domestic ministry or agency) will assume the role of the contracting authority and manage the grant awarding-procedures.

All donor profiles displayed on DevelopmentAid provide an interactive overview of the grant management modes.

Fig.1. Grant management modes for the EU Commission (EuropeAid)

Source: DevelopmentAid.org – Funding agencies profiles (European Commission).

What are loans?

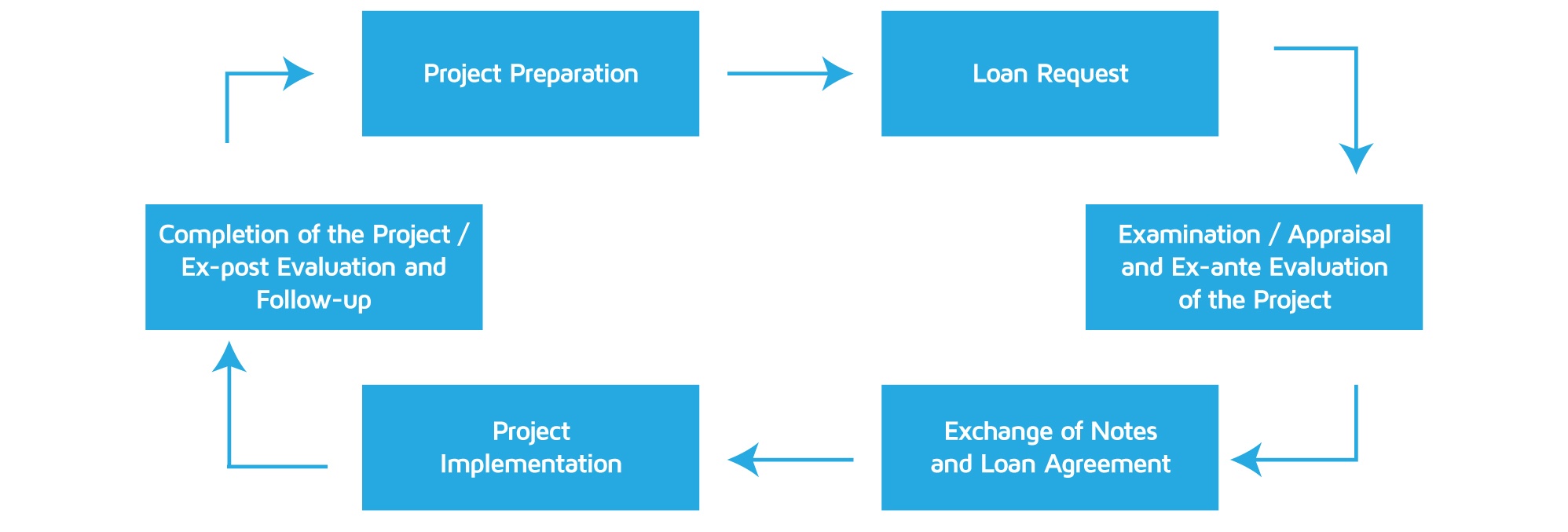

In the context of international development and cooperation, loans refer to repayable financial transfers made by donor countries either directly (bilateral transfers) or via multilateral organizations (multilateral transfers) for the benefit of developing countries. In the majority of cases, such loans provide developing countries with the low-interest, long-term, and concessional funds necessary to achieve certain development objectives. Based on the ODA framework the following types of loans can be identified:

Fig.2. Project Cycle of ODA Loans

DevelopmentAid is the leading provider of business intelligence and recruitment tools designed to assist those active in the development sector. Join today and gain access to exclusive information on the upcoming funding opportunities (tenders and grants) from the largest bilateral and multilateral donors.