The net-zero commitments and circular economy plans adopted by a large number of countries may significantly affect emerging economies. One of the reasons for this resides in the fact that climate mitigation policies are expected to decrease fossil fuel consumption by 2050 with emerging economies being among the main providers of this source of energy. These are the findings of a recent report issued by the International Institute for Sustainable Development (IISD).

Net-zero and circular economy

Net-zero commitments align with the Intergovernmental Panel on Climate Change (IPCC) directives that highlight the importance of countries achieving carbon-neutrality by 2050 to remain within a 1.5°C global warming temperature range. Circular economy initiatives focus on sustainability, meaning that goods must be reused and recycled instead of ending up as trash. Net-zero commitments and circular economy strategies usually address six sectors: energy supply, residential buildings, industry, transport, waste and agriculture, and forestry.

By analyzing net-zero strategies and circular economy policies, IISD has concluded that climate mitigation policies target a reduction in the use of fossil fuels. For example, the net-zero strategy instigated by California aims to achieve 60% electricity production from renewable energy by 2030 and to be 100% carbon-free by 2045. As emerging economies predominantly export natural resources to the rest of the world, the falling demand for fossil fuel will have a fundamental impact on their trade. For instance, sub-Saharan Africa’s total exports reached US$344 billion in 2018 with fossil fuel trade accounting for US$146 billion of that.

Falling Fossil Fuel Trade Flows

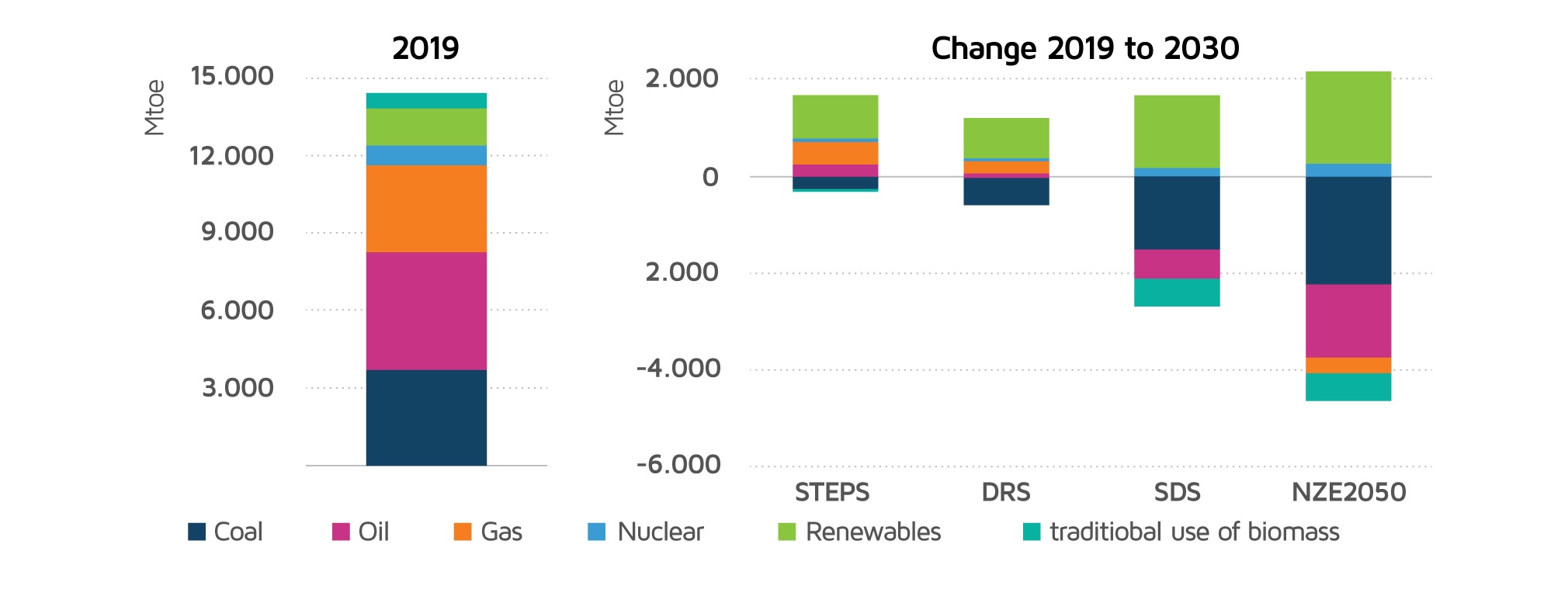

If the regulations imposed by governments follow the International Energy Agency’s global net-zero by 2050 scenario (NZE2050 in the figure below), oil consumption is expected to decline sharply as can be seen in the figure while a business-as-usual scenario, which will involve at least 3°C global warming, will result in a surge in the global demand for oil during this decade that will begin to fall around 2030.

Fig.1. Total primary energy demand by fuel and scenario

Net-zero commitments generally also involve coal reduction targets. For instance, 11 EU member countries have officially adopted strategies to phase out coal completely from the electricity generation process. The biggest growth in demand by 2040 is expected to be concentrated in the South and East Asia markets but sub-Saharan African countries, being located too far away, will not be able to supply that market. It is anticipated that demand will grow in India and Southeast Asia by 2030 while China will record a growth in demand for coal by 2025 but this will subsequently decline.

Expected impacts

Trade in fossil fuels plays an essential role for developing and least-developed countries. Sub-Saharan Africa, for instance, is a significant crude oil exporter with this accounting for more than 90% of the region’s total exports. The major oil traders in sub-Saharan Africa in 2018 were Nigeria (US$48 billion), Angola (US$40 billion), and the Republic of Congo (US$8 billion). Within the least-developed countries, the main exporters in 2018 were South Sudan (US$1.6 billion), Chad (US$1.5 billion), Sudan (US$1 billion), and Yemen (US$900 million). As for coal, sub-Saharan Africa exported about US$10 billion in 2018 with South Africa trading US$7 billion and Mozambique US$3 billion.

As net-zero and circular economy commitments target a reduction in fossil fuel demand, IISD anticipates that sub-Saharan African exports of crude and refined oil will have significantly decreased by 2050.