Connection to the internet has become almost essential during the coronavirus pandemic. With the frequent periods of lockdowns and enforced isolation over the last two years, people have relied on the internet to stay connected to friends and family, access educational and health services, and work remotely. It has therefore become a rapidly expanding market.

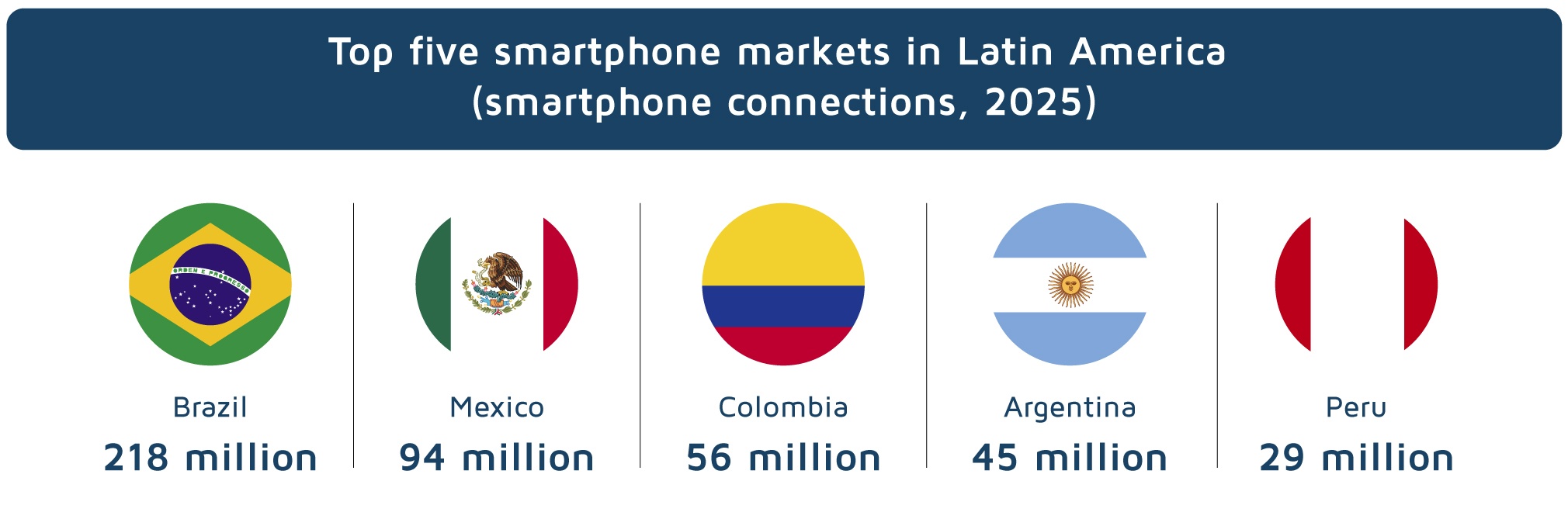

In Latin America, the statistics reflect the pace of evolution in recent years. The number of unique mobile subscribers in Latin America had reached almost 450 million by the end of 2021, according to the GSMA’s regional report. The expectation is that this figure will increase to 485 million by 2025 which represents 73% of the population. Around half of the new subscribers during this period will be in Brazil and Mexico.

In the next three years, the region will undergo huge investment in internet connection with more than US$73 billion to be spent on networks, particularly on the building of a 5G connection.

“The pandemic has emphasized the need for connectivity and the critical role of mobile technology. Now is the time for governments to reassess the business and regulatory environment for mobile services in order to accelerate investment and innovation for a connected society,” the study states.

Latin America connectivity

Source: Mobile 360 Latin America

The report shows the development of commercial 5G networks is already a reality in the region. 5G is expected to account for 12% of the region’s total connections by 2025 with some countries exceeding the regional average, most notably Brazil at 20%.

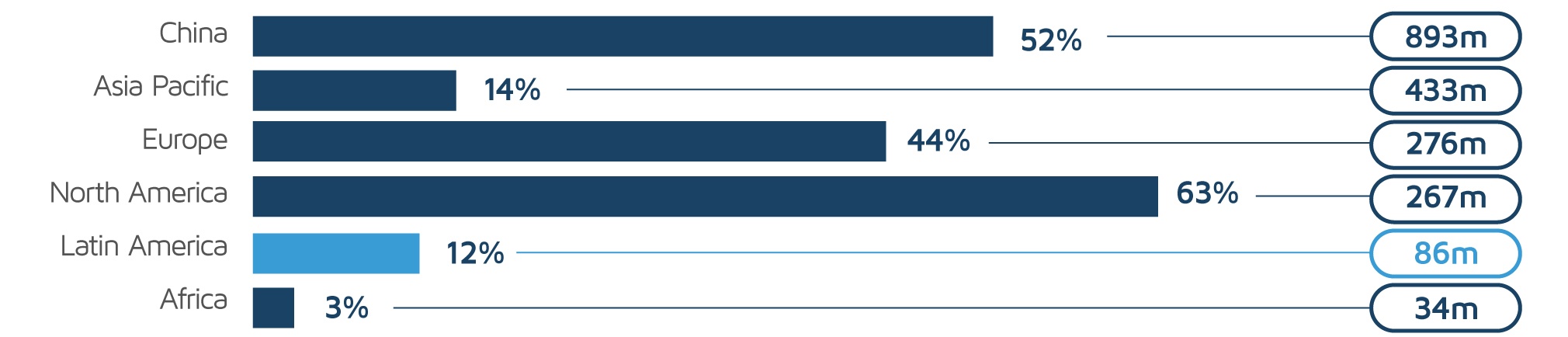

However, looking at the global context, Latin America will still remain far behind in terms of the development of new technology. The study points out that there will be 86 million 5G connections in the region in the next three years which represents only 12% of the population. This is not even half the number predicted for North America, for example, with 267 million 5G connections.

5G spectrum in 2025

Source: GSMA

What will change with 5G?

5G promises to be a watershed for countries during their post-COVID recovery. The technology will guarantee higher upload and download speeds as well as more stable connections and will impact the main sectors of the economy with a transmission speed up to 20 times greater than that of 4G.

In April 2019 South Korea was the first country to launch 5G commercially and today has the technology available in 85 cities according to the consultancy, VIAVI Solutions. China and the United States followed closely behind where today 5G is active in 376 and 284 cities respectively.

Now, these countries are already vying for the 6G version which promises to be 50 times faster than the previous generation. Countries are expected to perform the next migration by 2030.

Brazil and 5G

In terms of new internet speeds, Brazil is the most advanced country in Latin America. The government held a US$9 billion auction in 2021 to sell the broadcast rights. Less than a year later, the main Brazilian telecommunications operators have enabled part of the network to be ready to start operating. There will be investments of at least US$ 8billion being made this year.

According to regulations, telephone companies are required to ensure 5G is operational in the 27 Brazilian capitals by the beginning of the second half of 2022.

“If they authorized it today, tomorrow I would turn the 5G switch on in some cities,” said Paulo César Teixeira, President of Claro, one of the main telephony companies in Brazil.

The investments in telecoms are now mobilizing the main equipment manufacturers such as Swedish company, Ericsson, Finnish company Nokia, and the Chinese company, Huawei, which will provide the technology for the building of network connections throughout the Brazilian territory.

Infrastructure requirements have the potential to generate thousands of jobs. In addition to network deployment in urban centers, the 5G auction introduced several investment requirements that telecoms will be required to comply with such as building networks for highways and schools and activating the internet throughout the Amazon Forest region in addition to coverage of those areas that are not economically viable.

For experts, these regulations will help to reduce the lack of digitalization in the country, allowing access to the almost 40 million Brazilians who currently do not have a mobile internet facility.

According to a study prepared by Nokia in partnership with Omdia, 5G will have an impact of US$1.2 trillion on Brazilian gross domestic product between 2021 and 2035. Among the most positively impacted sectors will be technology, information, and communication (US$241 billion), government (US$189 billion), manufacturing (US$181 billion), services (US$152 billion), retail (US$88 billion ), agriculture (US$77 billion) and mining (US$48.6 billion).

Source: GSMA

No access

As Latin America considers developing new networks, at the same time it needs to think about how to include the millions of people who are still without any internet connection. According to a study organized by the Inter-American Institute for Cooperation on Agriculture, the Inter-American Development Bank (IDB), and Microsoft, almost 244 million – or 32% of the total population, do not have smartphones or any type of digital connection.

The disparity occurs mainly in the comparison between urban and rural areas. About 71% of Latin Americans who live in cities have a connection versus 37% of those who live in rural regions. This is perhaps the greatest technological inequality in the world.

“The absence of connectivity is not merely a technological barrier. It also represents a barrier to health, education, social services, work, and the overall economy”, said Marcelo Carbrol, Social Sector Manager at the IDB. “If we do not bridge this gap, the divide will continue to expand, and we will allow a region that is already the most inequitable in the world to become even more inequitable”.

The IDB estimates that some US$68.5 billion would be needed to overcome the digital gap and that 59% of this should be used to improve connectivity in the cities.