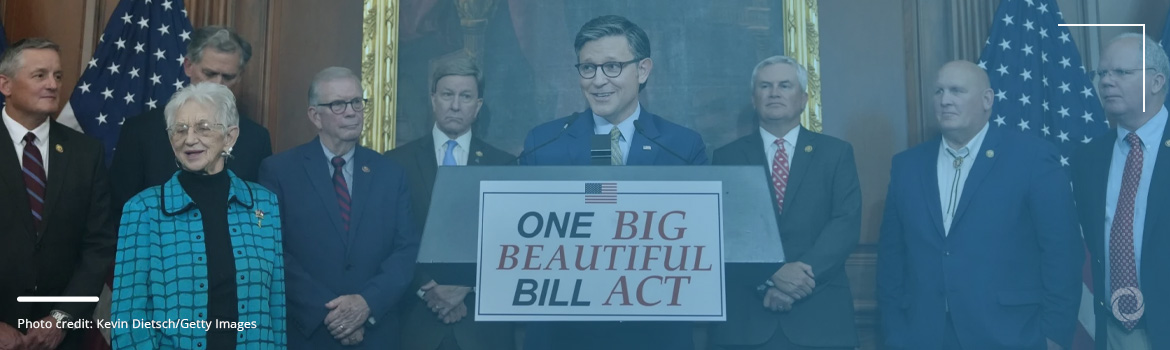

A new tax proposal, backed by US President Donald Trump and set to be voted upon in the U.S. House of Representatives on July 4, has alarmed the non-profit sector. Dubbed the Big, Beautiful Bill (BBB) vote, the legislation worth US$3.8 trillion aims to respond to the expiry of the 2017 Tax Cuts and Jobs Act (TCJA) with a new wave of reforms.

While broadly targeting tax loopholes, several provisions of the new tax regime have raised significant concerns within the US non-profit sector, provoking a dread of reduced funding and charitable work, political targeting, and weakened public trust. From higher taxes on private foundations to stricter limits on corporate and individual giving, the proposed changes could significantly curtail non-profit funding and therefore their operations.

Key provisions in the bill: The current situation vs. proposed changes

1. Private foundations

Excise tax on investment income for private foundations

- Current law: Private foundations are subject to a fixed excise tax rate of 1.39% on their net investment income.

- Proposed change: The bill introduces a tiered excise tax on private foundations based on the size of their assets:

-

-

- Under $50 million: 1.39%

- $50M–$249.9 million: 2.78%

- $250M–$5 billion: 5%

- Over $5 billion: 10%

-

Notably, the asset calculation includes those of related or affiliated organizations under shared control, significantly broadening the tax base. The Joint Committee on Taxation estimates that this could generate $15.8 billion over 10 years for the Treasury. Meanwhile, it discourages long-term endowments and penalizes philanthropic scale, experts warn.

2. Corporations

New floor for corporate charitable deductions

- Current law: Corporations can deduct up to 10% of taxable income for charitable donations, with no minimum threshold.

- Proposed change: Retain the 10% deduction cap but add a 1% minimum threshold. This means that only donations exceeding 1% of taxable income would qualify for deductions.

This could discourage donations from smaller companies, while generating an estimated $16.6 billion gain for the Treasury.

3. All 501(c) organizations

Expansion of excess compensation tax

- Current law: A 21% excise tax applies to salaries above $1 million for a non-profit’s top five highest-paid employees.

- Proposed change: Expand to include all employees, past or present, who exceed the $1 million threshold, including severance and deferred compensation.

Non-profits warn this would unfairly penalize them compared to for-profits but could generate $3.84 billion over the next decade.

Suspension of tax-exempt status for terrorist-linked organizations

- Current law: The Internal Revenue Service (IRS) must undertake a formal process to revoke a non-profit’s tax-exempt status.

- Proposed changes: The Treasury Secretary has unilateral power to suspend tax-exempt status for organizations who are suspected of providing material support to terrorists in the last three years.

Affected groups would have 90 days to appeal in court. Although humanitarian aid approved by the Office of Foreign Assets Control would be exempt, non-profits fear politicized enforcement, citing parallels to the contested 2024 H.R. 9495 bill.

Adjustments on unrelated business taxable income (UBTI)

Transportation fringe benefits

- Current law: Transportation fringe benefits (such as parking or transit benefits) incurred by tax-exempt organizations are not subject to unrelated business taxable income (UBTI).

- Proposed change: The BBB proposes treating expenses related to qualified transportation fringe benefits as UBTI, potentially increasing the taxable income of non-profits.

Non-public research revenue now subject to tax

- Current law: Non-profits that conduct research, even if funded by private entities, are typically exempt from UBTI provided that the research supports a public good and is shared freely.

- Proposed change: The BBB proposes taxing revenue from non-public research unless the findings are made publicly available

Name and logo royalties to be taxed

- Current law: Non-profits can currently earn royalty income from licensing their names, logos, or brand assets, for example, for merchandising or certifications, without paying corporate income taxes on those earnings.

- Proposed change: The bill removes this exemption. Any income generated from licensing a non-profit’s name or logo would now be treated as UBTI and taxed at the corporate income tax rate, which is currently at 21%.

4. Individual Giving

Temporary donations tax deduction for non-itemizers

- Current law: Charitable donations are only currently tax deductible for taxpayers who choose to itemize their deductions.

- Proposed change: The bill introduces a temporary above-the-line deduction for charitable contributions made by taxpayers who do not itemize. Single people can deduct up to US$150, and married couples filing jointly can claim up to US$300, but only for cash donations to qualifying public charities. Donations to donor-advised funds or supporting organizations are not included.

This move seeks to boost grassroots giving by making it tax-beneficial for everyday donors, at least until 2028, when the provision is due to expire.

Charitable contributions to scholarship-granting organizations

- Current law: Donations to scholarship-granting organizations are currently treated in the same way as any other charitable gift, qualifying for a standard charitable deduction.

- Proposed change: It introduces a new non-itemized tax credit for donations to K–12 private or religious school scholarships, capped at $5,000 or 10% of income, or whichever is less.

Non-profit leaders sound the alarm

Non-profit leaders have condemned the bill as a threat to charitable work and vulnerable communities.

Diane Yentel, President and CEO of the National Council of Nonprofits, called it “a direct assault on organizations that serve the most vulnerable Americans,” warning that it aims “to punish organizations that do not fall in line with the administration’s ideology” and could disparage organizations “without due process, a third-party investigation, and public evidence.”

Kathleen Enright, CEO of the Council on Foundations, criticized the proposed tiered excise tax on private foundations, saying,

“Increasing taxes on private foundations means fewer dollars to charitable organizations, from food pantries to disaster relief groups… This tax will hurt those who can least afford it.”