Spain is the 14th largest development assistance provider in the world. In 2018, according to preliminary data, the volume of the Official Development Assistance (ODA) provided by the country reached US$ 2.87 bn, growing by almost 20% compared to 2017. In the architecture of Spain’s development funding, an important role is performed by the Spanish Development Finance Institution (DFI) – The Compañía Española de Financiación del Desarrollo, COFIDES, S.A. In today’s article, DevelopmentAid continues its ‘DFI files’ series of articles and presents COFIDES – Spain’s public-private venture capital specialist abroad, member of the Association of European Development Finance Institutions (EDFI).

COFIDES is one of the oldest DFIs, established in 1988. It is a state-owned institution which provides medium and long-term financing for private investment projects. In its presentation, the Spanish DFI underlines that the projects it supports are based on profitability criteria and contribute both to the development of the host countries and the internationalization of Spanish companies and economy.

Customized financing products to each type of investment projects and development outputs

In its investment activity, COFIDES has access to several pools of important financial assets. On behalf of the Spanish Government, the company manages the Foreign Investment Fund (FIEX) and the Fund for Foreign Investment Operations for Small and Medium Enterprises (FONPYME). These two funds are mostly designated for the internationalization of Spanish companies. Besides this, it is also one of the accredited entities authorized to manage the European Union budget funds and the United Nations Green Climate Fund in a blended arrangement. Altogether, these funding sources allow the company to provide various direct and indirect financing.

Thus, COFIDES offers customized direct financing through capital and quasi-capital, loans, project finance and blended finance. Its indirect financing products range from participation in investment funds operated by third parties to venture capital in technological sectors and impact investing.

In its 31 years of activity, COFIDES has approved more than 960 projects, in close to 90 countries, including 44 projects in 2018 alone. By the end of 2018, the total portfolio of projects managed by the DFI amounted to €1.054 million while its commitments generated investments of €37 billion, according to the company’s annual report.

Besides promoting the internationalization of the Spanish economy, COFIDES aims to contribute to the development of the countries where it invests. This goal is intended to be achieved by creating jobs, reducing gender inequalities, fighting climate change and investing in affordable energy.

COFIDES geography and sector preferences

The investment distribution of the Iberic DFI is very diverse. In 2018, the company announced about one of the most important concluded transactions of the year: the Spain Oman Private Equity Fund was created between Oman and the Spanish public sector with a total investment of €200 million, half of which was provided by COFIDES.

The total investment portfolio of €307 million committed by the DFI in 2018 was split between 44 projects formalized worldwide.

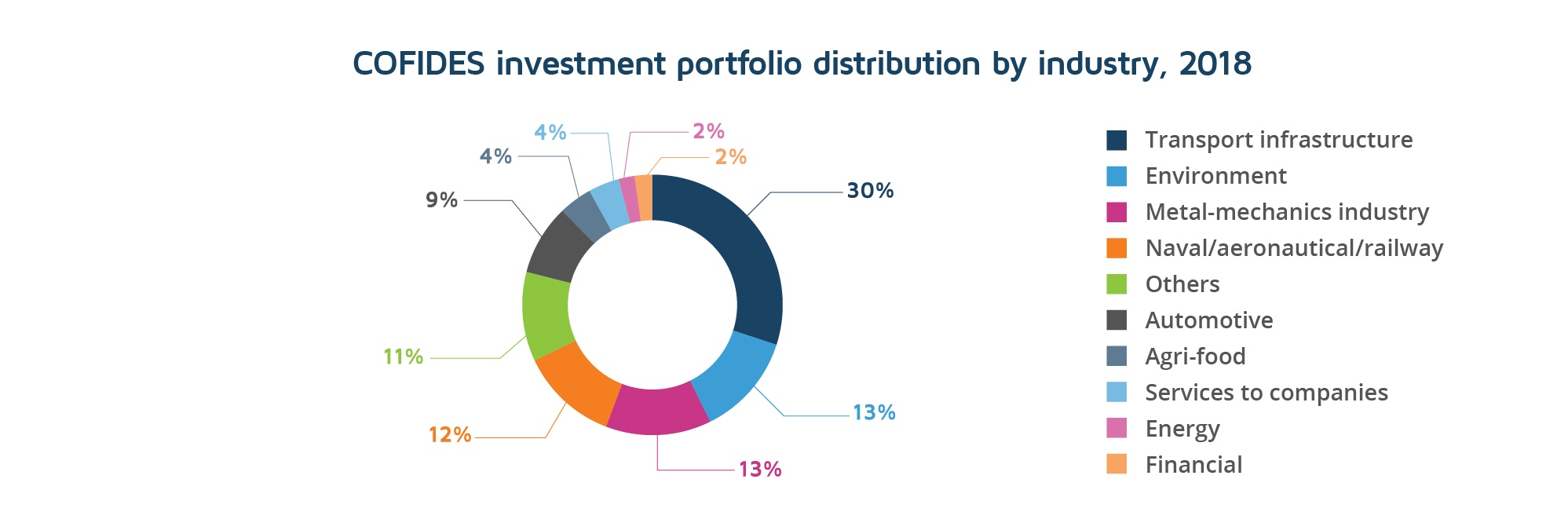

According to the company’s 2018 annual report, the main industries to which investments have been allocated were transport infrastructure, environment, metal-mechanics, naval/aeronautical/railway, and agri-food.

From a geographical point of view, COFIDES is traditionally interested in Latin American countries due to powerful historic and cultural ties. The region has benefited from 56% of the total commitments formalized in 2018. Mexico and Brazil are the ‘champions’ of the Latin American region, with 129 and 52 projects financed by COFIDES over the years. Northern America, with 39 projects, was the target of 16% of the 2018 COFIDES investment. The third most interesting region for the Iberic DFI in 2018 was Central and Eastern Europe where the company allocated 14% of its 2018 resources. Over the years, the Spanish funding institution has financed projects from Poland, Romania, the Czech Republic, Hungary and other countries from the region.

At the same time, a look at the COFIDES history of financing shows that the Spanish DFI has interests even in countries far from Madrid, both geographically and historically. The company has invested in 129 projects in China, India, Morocco and South Africa over the years. In 2018 it reported its first investment in Vietnam – a €450 thousand co-investment loan for a Spanish-daughter company specializing in the footwear industry.

COFIDES and the Sustainable Development Goals

Sustainable Development Goals 5 (Gender Equality), 7 (Affordable and clean energy), 8 (Decent work and economic growth), 9 (Industry, innovation and infrastructure), 13 (Climate action) and 17 (Partnerships for the goals) are those that the funding institution from Madrid concentrates upon. According to the company, each investment it approves has a component that envisages meeting one of the goals. The company calls this process “the external effects of financing”.

The effects mentioned by the DFI in its 2018 report suggest that:

- almost 30 thousand direct jobs have been created, with 17% of the workers being women;

- €95 million was raised in tax revenue by the host-governments;

- 39 climate change mitigation and adaptation projects from 2012 to 2018;

- €5.5 billion total investment in climate action and affordable energy across the globe

Development Finance Institutions are important pieces in the world development financing puzzle. DevelopmentAid.org offers its members comprehensive information about DFIs and the funding opportunities available including the finances managed by them. Become a DevelopmentAid Professional member today and stay tuned with the latest opportunities and news.