Mercy K. Mwangi, a front office service manager in a hotel in Nairobi, Kenya, is a happy African woman. She has a decent job, a stable income for her family and certainty about her future career. Mercy and the other 259 people working in this hotel know that Swedfund, the Development Finance Institution (DFI) from Sweden, has invested both in the hotel and in the future of its employees. This project, financed by the Swedish DFI, is a good example of how the international development sector can interact with private businesses. In fact, Swedfund has made many more business investments with the focus on humanity.

A catalytic role in a volatile environment

Financing businesses in developing countries is a risk. It is the role of the DFIs to take on that risk and mix ‘development’ and ‘business’. “Our mission is to be additional and invest where others consider the risk too high” explained Katinka Wall, Swedfund’s Strategic Communications specialist when asked by DevelopmentAid about investments undertaken in a volatile business environment. Regarding particularly dangerous situations and earlier-than expected exits from businesses, she added that “since 1979, there have been, and will be, single portfolio companies that are not developing according to the plan or situations that we have not foreseen”.

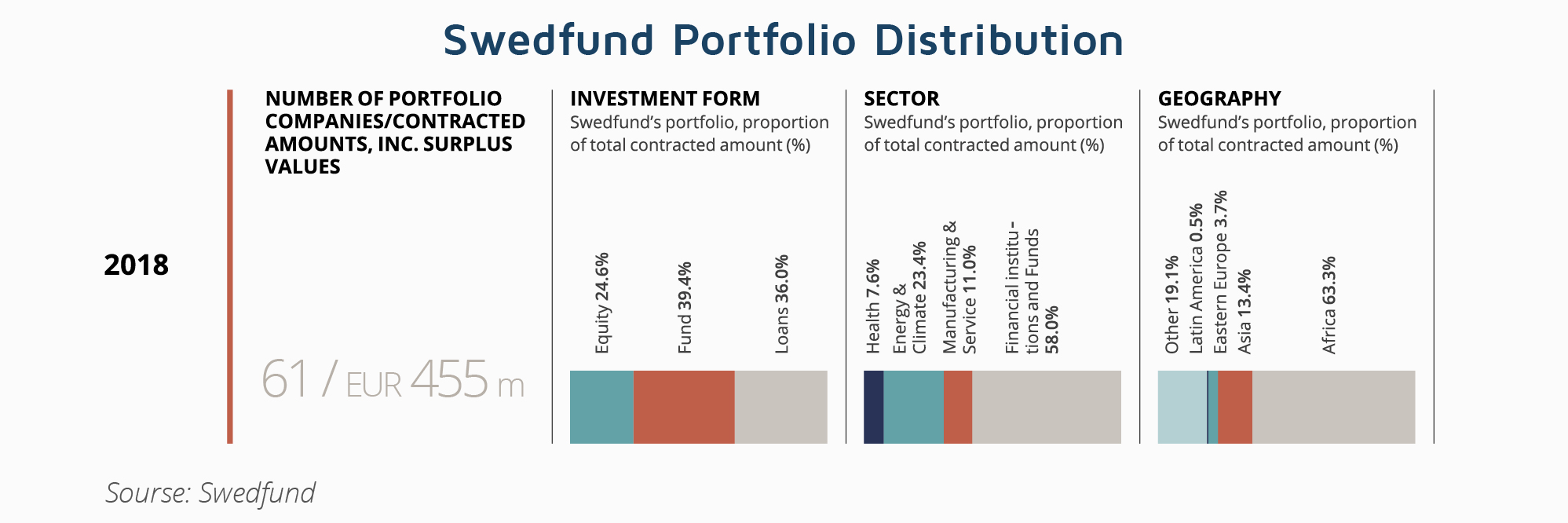

Since 1979, Swedfund has made around 250 investments. The DFI had a portfolio of €455 million in 61 projects at the end of 2018. Eleven investments, worth almost €130 million, were made during that year while the figures for 2019 are yet to be published. Around 60% of the company’s investments are made through equity and quasi equity instruments. This means that Swedfund is present on the Board of the business units that it invests in or in the LPAC – the advisory committees – of the funds that the DFI has invested in. The remaining 40% of the investments is funneled through loans.

According to Katinka Wall, in 2020 Swedfund will maintain its strategic focus on the least-developed countries:

“Our focus on Sub-Saharan Africa and the least developed countries in South and East Asia will continue in 2020. In these regions, Swedfund can be truly additional and catalytic in three sectors: Energy & Climate, Financial Inclusion and Health. By focusing on these sectors, we will increase people’s access to renewable energy, decent jobs and health services”

With its headquarters in Stockholm, Swedfund also has a second office in Nairobi, Kenya.

Over 50% of Swedfund’s investment portfolio relates to projects connected to businesses in the financial sector such as funds and financing institutions. Infrastructure (energy) is the main target of 23% of the money invested by the DFI while “social” infrastructure is the focus of 18% of investments. “Overall, in 2018, Swedfund managed to mobilize up to 30% of private capital”, explains Katinka Wall.

Empowering women

In Africa, the majority of women work in insecure, poorly paid jobs and with few opportunities for advancement according to the United Nations Women. Swedfund has been one of the actors working to improve ameliorate this situation. Moreover, it is the first DFI in the world to have “gender’ investments as a target. Katinka Wall says gender is one of the organization’s core impact areas. The directives of Swedfund’s owners (the Swedish government) have included gender targets since 2016. As of 2019, Swedfund is the first DFI in the world to have an owner stipulating that at least 60% of its portfolio shall qualify as gender investments.”

In one of the Nairobi’s prestigious hotels, financed by Swedfund, the proportion of women in the total workforce is 36% with the corresponding ratio at management level being 40%. “I am happier and have much more fun at work now. The management truly listens to us and challenges us to make use of our learning and abilities. This makes us grow professionally as colleagues as well as individuals” says Mercy, the front desk manager.

The Women4Growth programme, implemented by the DFI, encourages companies to realize the full potential of their female employees. Swedfund also aims at freeing up time for women and girls, thus making them less “time poor”. This term refers to the hours that women and girls in the poorest countries spend collecting firewood and water. Investments in water and energy help to free up time for people to go to work, attend school or undertake other activities. The number of jobs in Swedfund’s portfolio companies reached 167,000 in 2018. The proportion of women in the senior management of these companies is 34%.

“Our mission is to be additional and invest where others consider the risk too high”

Asked by DevelopmentAid, Swedfund’s Strategic Communicator Katinka Wall described the Swedish DFI’s work in unstable and complicated environments. “Swedfund has 40 years of experience working in challenging environments in developing countries. Based on our experience we have developed a business model that rests on three pillars, impact on society, sustainability and financial viability – all three pillars are of equal importance to Swedfund. Every investment is evaluated based on these pillars and the performance of the investee is analysed in relation to these three pillars during the investment period and when exiting”.

“Our capital comes with competence and support. We use our extensive knowledge within sustainability, impact and financial aspects to advance our portfolio companies performance within our three pillars. Based on an analysis, we use the support of consultants when required and to enhance the work of our portfolio companies and to validate their performance”, added the source.

Thus, upon necessity, the DFI contracts the expertise of financial, marketing and technical experts when performing due diligence processes. “We also use legal consultants to make sure agreements are valid in the local context and possibly for other matters. We also use consultants on a regular basis when we exit an investment” explains Katinka Wall.

In Africa, and other regions of Swedfund’s operation, external consultants are contracted regularly. “In high risk situations we always involve external consultants to perform Environmental, Social or Governance (ESG) due diligence. We use external consultants’ services regularly to conduct audits in our portfolio companies and to support our portfolio companies with value adding projects within ESG through Technical Assistance funding. In addition, we conduct impact assessments with the support of researchers/consultants to understand the development effects to draw learnings from.”

Securing a contract with development organizations such as Swedfund is a real opportunity for individual consultants. DevelopmentAid offers unique tools that help experts to land jobs. Become a Professional member today and secure your next contract in the international development sector.

You can explore the profiles of the European and North American Development Finance Institutions in our DFI files series. Next profile to be published on DevelopmentAid platform is about the Swiss SIFEM – the Investment Fund with growing role in climate financing.