The Investment Fund for Developing Countries (IFU) is Denmark’s most experienced investor in developing countries and emerging markets. Since 1967 it has participated in over 1300 projects worth close to US$ 31 billion, of which the IFU and its managed funds contributed almost US$ 3.5 billion, the rest being private capital and co-funding. As of 2020, the IFU will no longer make new investments in fossil fuel-based power production projects. The institution aims to increase the percentage of climate-relevant projects within its portfolio to at least 40% by 2030.

The IFU was established by the Danish government in 1967 as a state-owned DFI for the purpose of promoting industrial development in developing countries by facilitating private investments. Over the last year, both the scope and mandate of the fund have changed significantly, for example from its emergence as a strictly tied fund in 1967 (where the project procurement is limited to companies from the country providing the aid or the recipient country) to becoming an untied fund in 2017.

The IFU offers risk capital and advice to companies wishing to set up business in developing countries and emerging markets. The IFU’s main investment tools are equity, mezzanine financing, loans and guarantees. Finance and services can be provided for start-up companies, joint ventures, acquisitions and for the expansion of existing companies. The IFU’s investment for a single project ranges from US$750,000 to almost US$40 million.

The IFU acts as a fund manager for a number of investment funds based on public and private capital – the Danish SDG Investment Fund, the Danish Climate Investment Fund (DCIF), the Danish Agribusiness Fund (DAF), IFU Investment Partners (IIP) and the Investment Fund for Central and Eastern Europe (IØ). Furthermore, IFU manages Danida Business Finance (DBF).

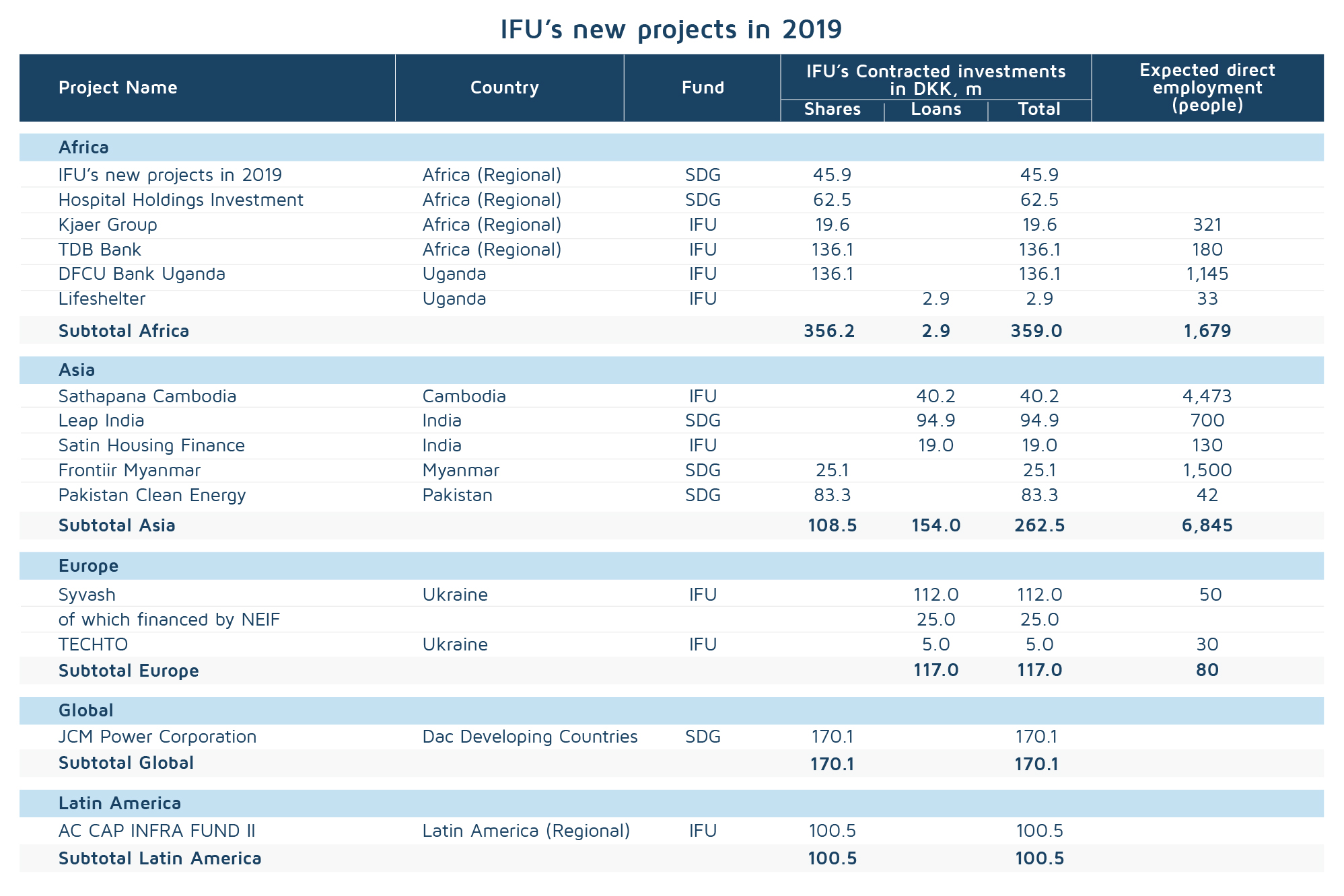

In 2019, the IFU and its managed funds committed to investment totaling approximately US$ 160 million in 25 new projects, an amount that fell below the institution’s expectations. This was as a result of investments being delayed or cancelled due to external circumstances. The IFU’s strategy is to continue to grow its investments in order to reach an annual investment volume for the IFU and its managed funds of between US$300 and US$350 million in 2021. At the end of 2019, the IFU’s active portfolio covering all investments consisted of 196 project companies.

In 2019, the IFU made investments in renewable energy with three new projects involving Pakistan, Ukraine and a global platform. To support financial inclusion, the IFU made four new investments within the financial sector. Two of these investments related to microfinance institutions and two involved banks in Africa that provide finance for small and medium-sized local companies and people in rural areas. Across all funding areas, investments in Africa accounted for almost 30% of total investments, with investments in Asia representing approximately the same percentage. The remaining 40% was invested in Latin America, Europe and in projects with a global focus.

Source: www.ifu.dk

In recent years, the IFU has focused on adjusting its investments to contribute to the achievement of the 2030 Sustainable Development Goals agenda. The institution has been able to increase funding and, in 2018, established the Danish SDG Investment Fund. The fund is an 11-year closed end fund based on a public-private partnership, and has a total commitment of almost US$ 700 millions. In 2019, among other beneficiaries, the fund invested in a healthcare company which establish hospitals and health clinics in eastern and southern Africa. Other investments were distributed across university education, renewable energy, healthcare, agriculture and IT.

In 2020, the Danish Government launched “Denmark’s Green Future Fund” with the aim of supporting the green transition in Denmark and abroad. The Danish government has allocated US$150 million for the IFU to invest in climate-related projects in developing countries. The DFI states that it has excellent experience of investing in projects that have supported the green transition in developing countries. IFU has a large portfolio of renewables which has already exceeded 1,150 megawatts. The fund intends to further build on this focus, turning its attention towards renewable energy, energy efficiency and climate adaptation projects.

As a DFI, Denmark’s Investment Fund for Developing Countries works on commercial basis and does not provide aid or grants. You can review Denmark’s open tenders of humanitarian aid and development assistance on the DevelopmentAid profile of DANIDA, the country’s development agency.