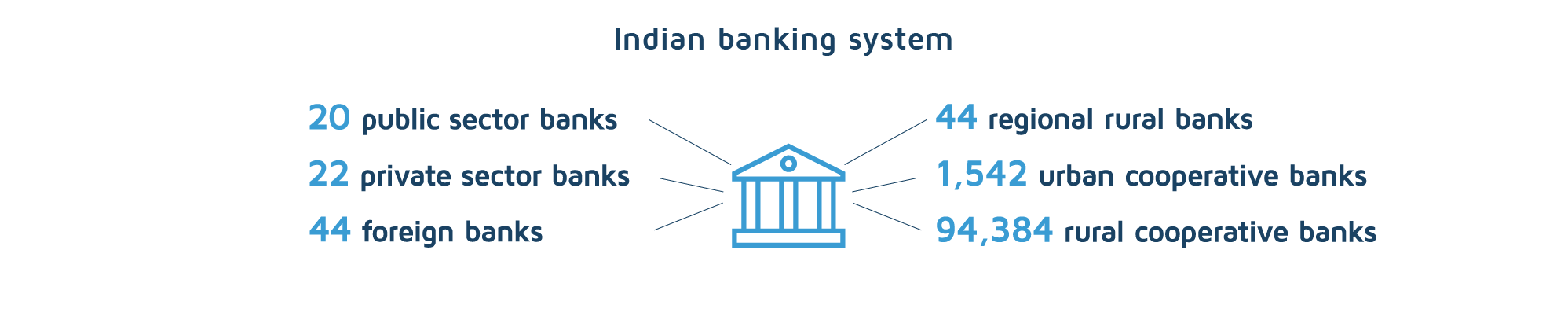

As an industry vital to the country’s economy, the Indian banking sector will be responsible for mitigating the repercussions of the pandemic. Its Public Sector Banks (PSBs), which hold 70% of the market share, will be the key driver of economic recovery and growth. At the same time, an Economic Survey points to the necessity of making the sector more efficient to adeptly support India’s aspiration to become a US$5 trillion economy in the post-COVID era. This article delivers an overview of the most important Public and Private banks in India.

Although the Indian banking sector remained stable in the first 9 months of 2020, lenders should revise their business strategies, raise capital and ensure credit flow as well as the resilience of the financial system. Moody’s Investors Service Inc. estimates that PSBs will need US$28 billion of capital over the next two years to restore their loss absorbing buffers. A sharp slow-down in India’s economic growth is going to affect the asset quality of PSBs resulting in significant increases in credit costs and low profitability indicators.

Specialists of the Indian Reserve Bank have catalogued the country’s banking sector as being generally resilient and capable of withstanding the global downturn well.

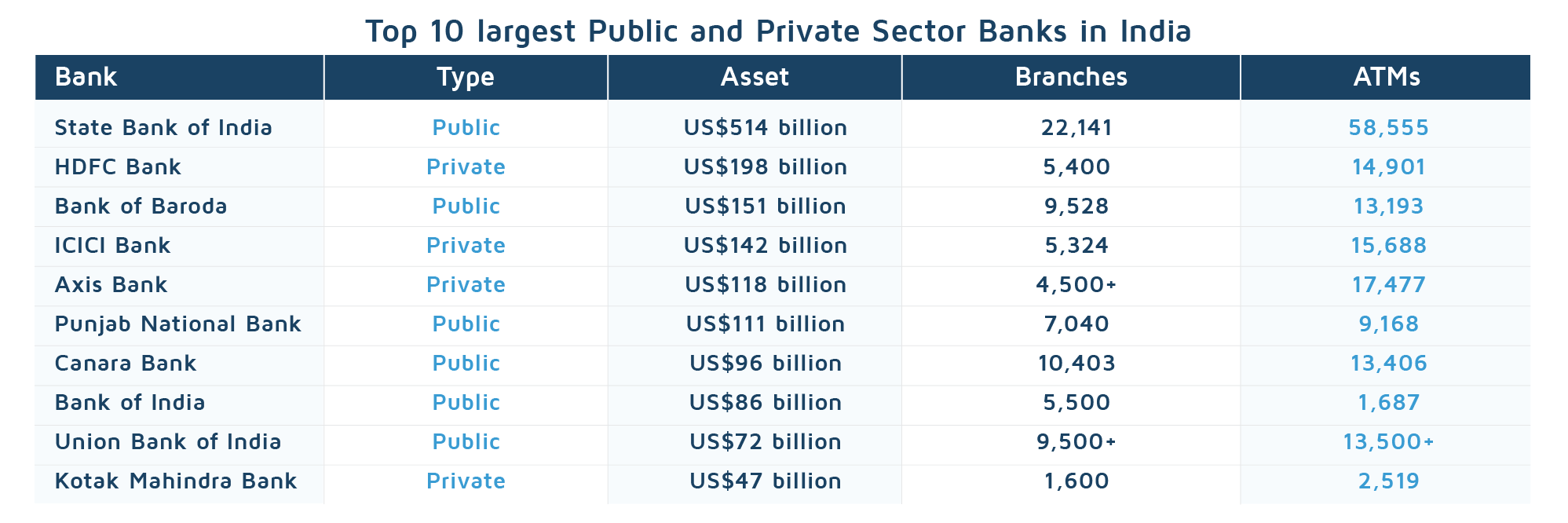

DevelopmentAid presents the Top 10 largest Public and Private Banks in India.

The State Bank of India (SBI), the 55th largest bank in the world, has the most important market share in India with around 23%. Since its foundation in 1955, SBI has developed its branches and services and now has over 195 foreign offices across 36 countries. SBI, along with other public banks, has become a strong pillar for economic growth in the country. The Public State Banks, among them SBI, will carry on the burden of pushing the economic recovery of India, hit hard by the pandemic crisis. The SBI, in which the Indian government holds a 61% stake, generated a revenue of 40 billion dollars in 2019. Some banking analysts agree that SBI has been undervalued. The Bank makes less profit than it potentially could when compared to a private bank which does not have to align its activity with the government’s political priorities and social responsibility as a Public Bank must do.

The largest Indian private sector bank, HDFC Bank, has a greater market capitalization than the largest public sector bank. Despite the fact that the State Bank of India’s balance sheet is four times larger than that of HDFC Bank and it has ten times more customers, the private bank is worth three times more than the public bank. The HDFC Bank generated a revenue of US$17 billion in 2019, earning awards and industry recognitions.

The HDFC is heavily engaged in human and economic development, providing a wide range of initiatives from financial literacy to skill training and livelihood enhancement such as improving sanitation infrastructure, promoting health and drinking water, generating awareness about nutrition, and conducting blood donation.

Over 131 million people across 21 countries of the world have become the Bank of Baroda’s (BoB) customers. The Bank undertakes revolutionary and frequent changes which could explain its success in adapting its financial services to the dynamic economic environment. The Bank has achieved substantial progress in technology, integrating various platforms to generate synergies and build strong relationships with its customers. The Bank of Baroda has become India’s third largest lender after the merger with the other two banks in April, 2019, which has brought unprecedented popularity. BoB enjoys a place amongst the Best 10 Banks in India 2019.

Listed as one of the Big Four Indian banks having subsidiaries in Canada, the United Kingdom, and the United States, the ICICI Bank plays an important role for country’s economy. Digital and technology platforms are key strengths of the Bank which have been recognized and awarded on numerous occasions. The Bank’s most recent initiative is the new program for startups, “iStartup2.0”, that encompasses a holistic and comprehensive approach. A combination of banking and beyond banking services endeavor to meet customers’ needs and include regulatory assistance, analytics, staffing, accounting, customer acquisition and digital outreach to customers, among others.

The disruption caused by the pandemic has made investment in digital and technology inevitable. The Axis Bank has developed new digital solutions to make banking more accessible. The “Soft POS”, designed to support small merchants and vendors, has become the first financial payment service in India that has transformed everyday smartphones into merchant Point of Sale terminals. Axis Bank was the first Bank in India to connect the Bharat Bill Payment System (BBPS) with schools, giving students the ability to pay their school fees digitally. The Net Interest Profit grew by 19% in the second quarter of 2020, compared to the same period last year. A similar increase has been experienced in the case of deposits which grew 19% year-on-year on a quarterly average basis.

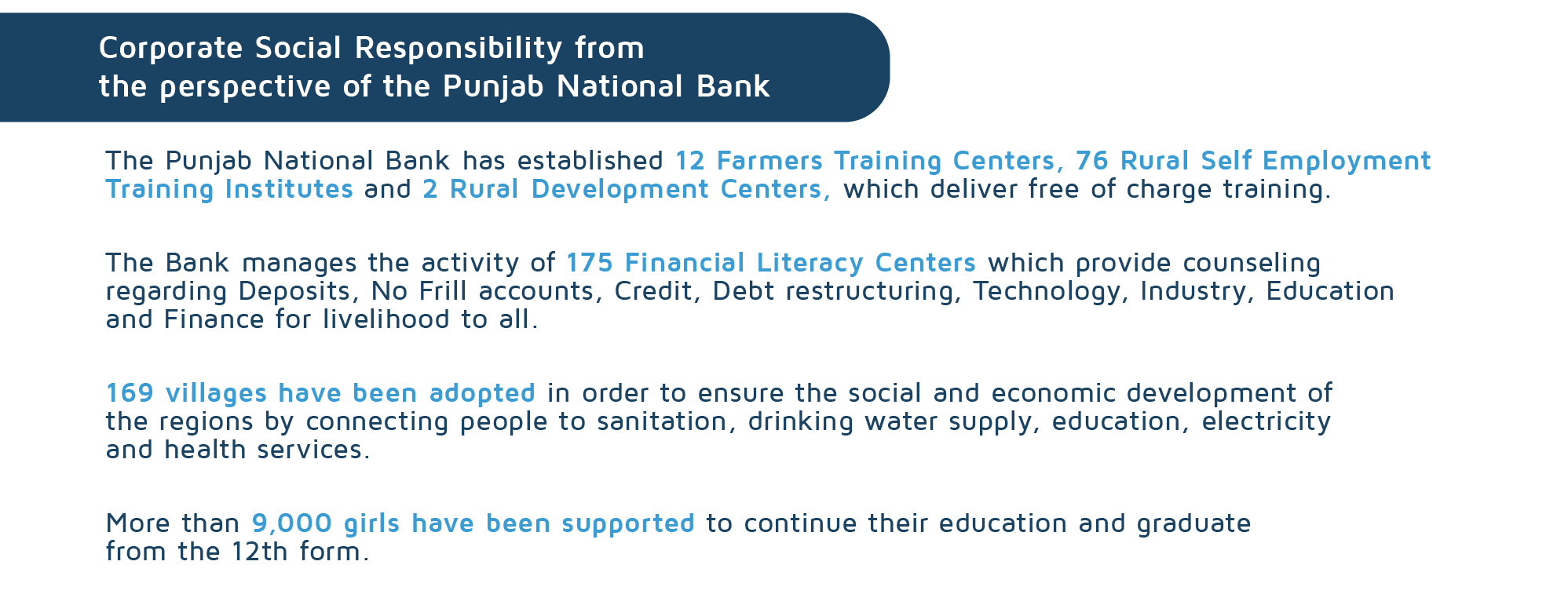

Being one of the leading commercial banks in India, the Punjab National Bank has positioned itself as one of the largest Public Sector Banks. In the spring of 2020, the United Bank of India and the Oriental Bank of Commerce merged to form the Punjab National Bank. As a result, the Bank’s sucess is reflected in a growing customer base and increasing global business. The PNB’s strategy has relied on qualitative business growth, recovery and preventing fresh losses. Corporate social responsibility has also been stressed as one of the Bank’s priorities.

The Canara Bank (CB) is one of the oldest public sector banks in India and become the fourth largest after merging with Syndicate Bank in the spring of 2020. CB was the first bank to open a “Mahila Banking branch” to satisfy the financial requirements of its female clients. Its employees pursue operational efficiency, asset quality, risk management and expenditure of the global network. During FY2019-20, the total income of the Bank increased by 6.30% year on year while the Current and Saving (CASA) deposits of the Bank increased by 12.24% during the same period. The number of registered users under Mobile Banking rose 93.21% y.o.y and Net Banking users increased by 76.76% y.o.y as at March 2020.

Given its strong national presence, the Bank of India (BoI) has also succeeded in extending its international operations. The Bank has an overseas presence in 18 foreign countries across five 5 continents. More than 48,000 employees work to provide proactive and innovative banking services to its customers. BoI is known as the founding member of the Society for Worldwide Interbank Financial Telecommunication, also known as SWIFT.

The Union Bank of India is the first large public sector bank in the country to implement a 100% core banking solution, allowing customers to operate their accounts as well as enjoy banking services from any branch of the network. The bank has been awarded for its innovation in technology and financial solutions. The Indian Government holds almost 90% of the Bank’s total share capital which recently announced the rollout of 125 Regional Offices, extending their network to a branch in every state of the country.

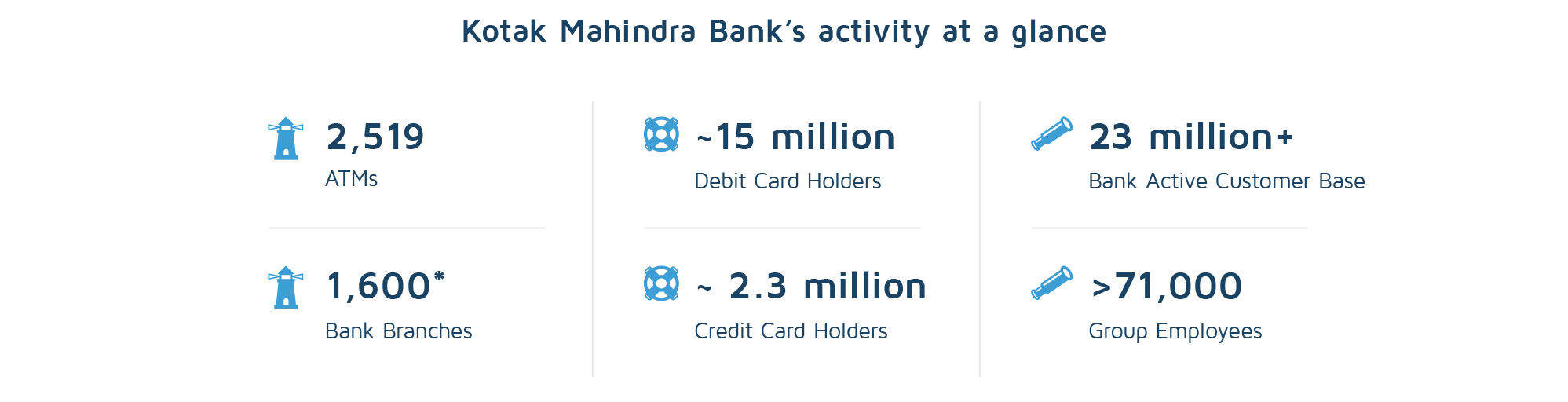

Kotak Mahindra Bank was established in 2003 and it is now listed among the top largest Banks in India. It is the first non-banking finance company in the country to obtain a bank license. The main business activities of the Bank are organized into consumer banking, commercial banking, corporate banking, treasury and other financial services.

The Indian authorities are taking unprecedented steps to support the financial sector and to make it more efficient, while banks are struggling to deal with the fallout of the coronavirus pandemic. To stay informed about the latest global development news subscribe to the DevelopmentAid Newsletter and gain access to the latest information. You can also become a DevelopmentAid member and contribute with expertise from your own field.