Every year, billions of dollars are pumped into developing countries by multilateral development banks (MDBs) to help them to boost their rate of growth. Established in the 1940s, these financial giants operate both regionally and internationally often providing preferential loans and grants to governments and the private sector. This article reveals who the largest MDBs are, how much they have invested over the last few years, what kind of assistance they provide as well as other useful details.

Multilateral development banks vs private financial institutions

A multilateral development bank is an international financial institution whose purpose is to provide financial assistance to developing countries, typically in the form of loans or grants, in order to encourage social and economic development. Here’s the list of multilateral banks: the World Bank, the European Investment Bank, the Asian Development Bank, the African Development Bank, the European Bank for Reconstruction and Development are only some of the best known MDBs.

Unlike private financial institutions, MDBs benefit from a subsidized capital base and access to other subsidies and are focused on development goals rather than on bumping up their shareholders’ profits. As such, they often provide concessional assistance and grants for projects related to infrastructure, energy efficiency, SMEs development, education, and environmental sustainability etc.

MDBs played an important role in mitigating the consequences of the 2007-08 global financial crisis. They almost doubled their assistance to exceed $200 billion in 2009 in a moment when private banks had to undergo deep reform to regain their lending capacity.

What about the shareholding structure of MDBs?

The MDBs’ strength and lending capacity is, to a certain extent, related to their shareholding structure. The largest multilateral development bank in the world is the World Bank’s International Bank for Reconstruction and Development – has 189 members indicating that almost every country in the world holds a share in this institution. On the other hand, the recently instituted New Development Bank has only five members. Member countries, the shareholders, include both donor countries and borrowing countries.

However, on taking a closer look at the shareholding structure of MDBs, it can be observed that, despite their large number, there are certain groups of countries that hold the controlling stakes in many of these financial institutions. According to the Overseas Development Institute, more than 60% of the voting shares of many MDBs are concentrated among the five biggest shareholders of whom Germany, Japan, and the USA are most often found. Countries holding a sufficient shareholding have the right to block decisions within these institutions.

What kind of assistance do MDBs provide?

MDBs provide assistance for investment projects and policy-based loans. Project loans include large-scale infrastructure projects, as well as social projects including healthcare, environmental and education initiatives etc. Policy-based loans provide governments with financing in exchange for their commitment to carry through particular policy reforms such as the privatization of state-owned companies or reforms in particular sectors or industries.

Do MDBs provide financial assistance on preferential conditions? Yes and no. Middle-income governments, some low-income governments, and private sector firms in developing countries can benefit from financing on market-based terms (non-concessional assistance), typically in the form of loans. At the same time, MDBs also provide grants and loans at below market-based terms (concessional assistance) to the governments of low-income countries.

Other examples of the largest multilateral banks, such as the African Development Bank, Asian Development Bank, Inter-American Development Bank, and the World Bank, provide loans primarily to governments. Others provide credit facilities to commercial institutions who then offer lending to the local private sector.

Types of multilateral development banks

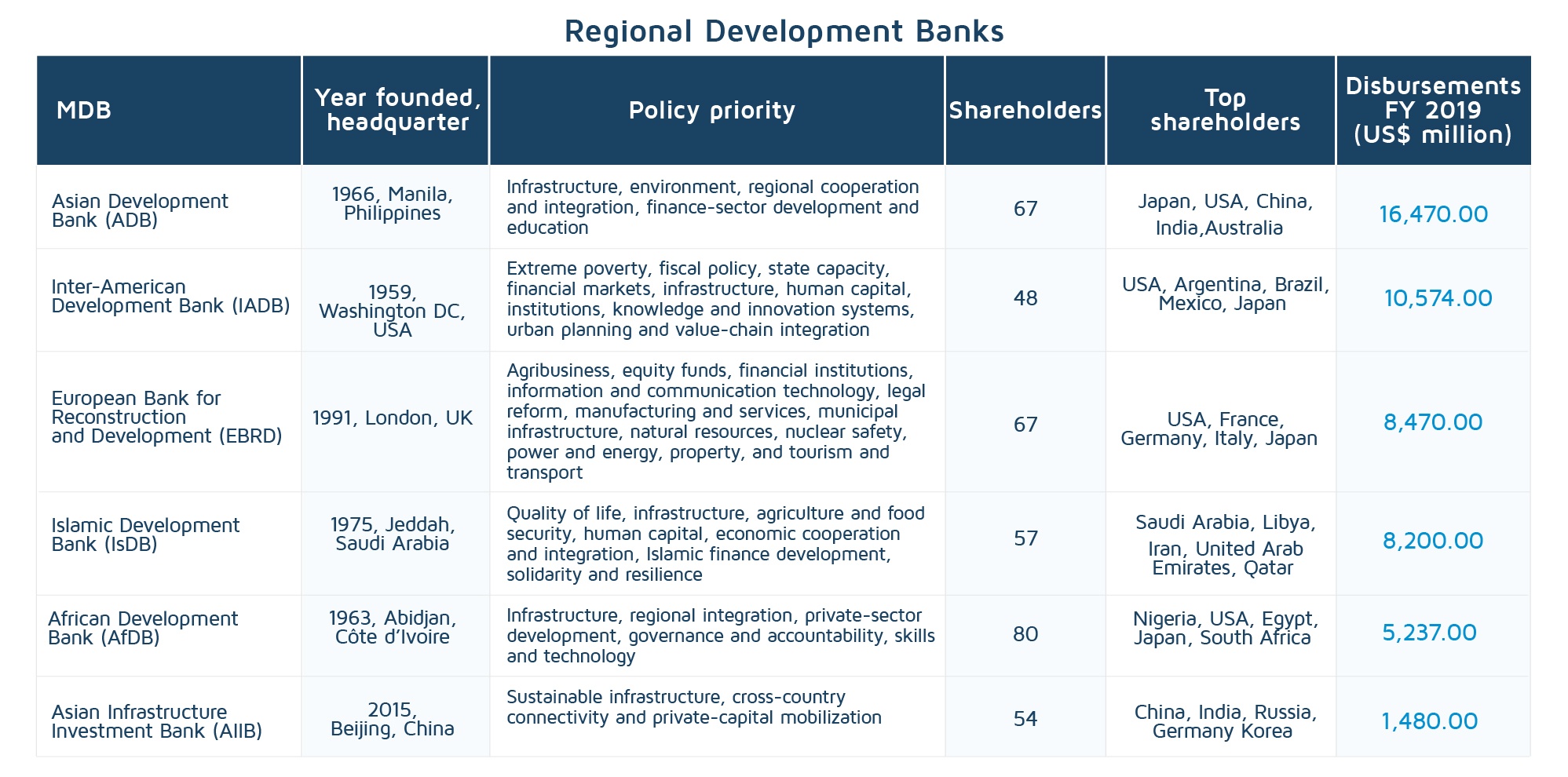

According to their geographical scope, MDBs operate as global or regional multilateral development banks. Global banks have a wide geographical scope across several regions, such as the World Bank. Regional development banks (RDBs) cover one entire region such as the geographical focus on Africa in the case of the African Development Bank (AfDB). Global banks have a larger and more geographically dispersed membership than regional banks, as well as more substantial portfolios.

Multilateral banks can also be classified into two types according to their purpose. The first type, such as the Inter-American Development Bank (IDB), includes the largest and best-known institutions that make loans and grants, often distinguishing between poorer, borrowing members, and wealthier, non-borrowing members. The second type of multilateral development banks are formed by governments of low-income countries that can then borrow collectively in order to secure more favorable rates. The Caribbean Development Bank (CDB) is an example of this type of MDB.

The largest international and regional multilateral banks

In terms of disbursements, several multilateral development banks account for more than half of the total disbursements in the MDB system. Such is the case of the International Bank for Reconstruction and Development, International Development Association, and International Finance Corporation – all part of the World Bank’s financing system – as well as the European Investment Bank. These are followed by a number of regional development banks that handle billions of dollars in annual disbursements. The list below features details of the six largest international multilateral banks, as well as six of the largest regional banks.

Who are multilateral banks accountable to?

Multilateral development banks (MDBs) are seen as agents of their member states and, enjoy a range of immunities and privileges. In addition to this, they are also actors in their own right. Over the years, MDBs have been censured for avoiding accountability to shareholders who are affected by their decisions and operations. Although changes to internal administrative laws have succeeded in increasing transparency, the instigation of self-regulatory frameworks and provisions for independent review, the absence of any external oversight of the MDBs has been the biggest criticism in terms of the accountability of such institutions.

DevelopmentAid is a leading platform in the development sector, aggregating information on tenders, grants, jobs, experts, organizations, donors, and references. To learn more about funding opportunities from the Asian Development Bank, the African Development Bank, the World Bank, or the European Bank for Reconstruction and Development, register on the DevelopmentAid platform and become a member.