Developing countries are expected to experience a dramatic decline in Foreign Direct Investments (FDI) as a result of the ongoing coronavirus pandemic, with figures expected to fall under the level registered in the years following the global financial crisis of 2007 – 2008. Even the most optimistic scenario of the global contraction in FDI will degenerate in increasing poverty rates and lower potential of job creation.

So far FDI have contributed to sustainable growth in developing countries, helping to create jobs, raise living standards, and enhancing innovation. Now that the world is faced with the Covid-19 crisis, investors seem set to channel less proceeds, put off or even cancel investments in developing countries against the background of high uncertainty.

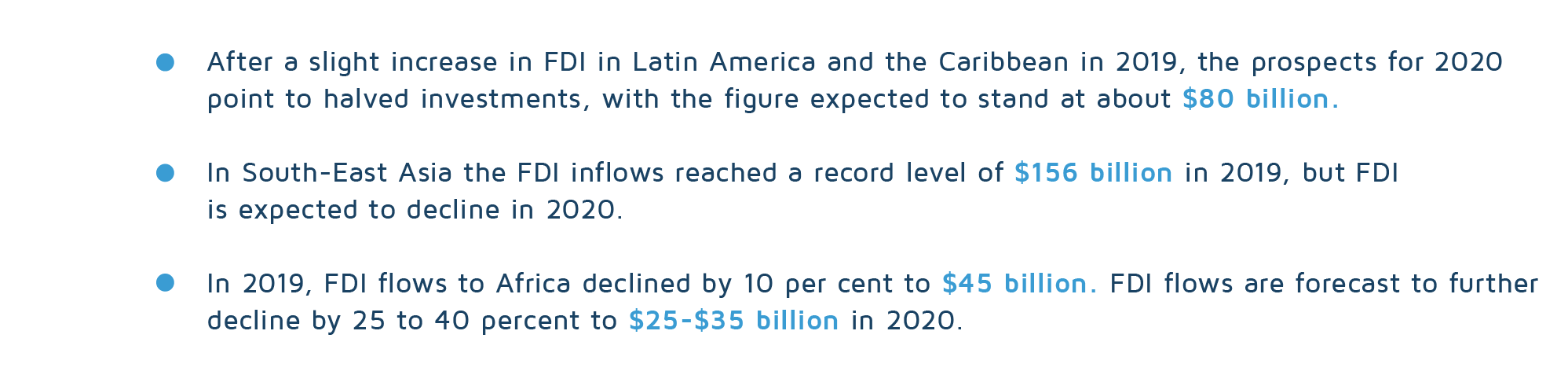

Global FDI is expected to plunge below $ 1 trillion in 2020, which is by 40% less compared to 2019, according to a forecast by the United Nations Conference on Trade and Development. The decrease is the lowest registered since 2005. The downturn could last in 2021 as well, when FDI estimated to further decrease by another 5 to 10%. This will strike a double blow to the developing countries, as many of them have already been unable to deliver proper economic support measures. All these together serve as reason for the Organization for Economic Co-operation and Development to estimate that 70-100 million people will be pushed back into extreme poverty, at least twice as many into poverty, with hundreds of millions of jobs lost and livelihoods affected.

The FDI contribution to direct job creation has been reduced by nearly 50%. Around 500,000 jobs were supposed to be created in 2020. These employment opportunities have been lost along with other millions of jobs, impacting severely the workers’ livelihoods. Industries such as tourism, retail and transport services, key sectors in delivering productivity in developing countries, are at risk of being left behind in terms of FDI flows.

Adequate support measures are needed to mitigate the effects of the decrease in FDI. In addition to internal financial sources, donors’ external financial support might be crucial now that the prospects regarding the FDI flows are uncertain. Apart for financing, donors could bring in their expertise to redress the situation already exacerbated by the crisis and assist governments to build an attractive investment environment

In 2019, 54 countries have introduced more than 100 measures designed to boost foreign investments such as liberalization and facilitation. Asian developing countries have actively been involved in adjusting their framework to the market requirements. Measures in connection with trade liberalization have impacted industries like mining, energy, finance, transportation and telecommunication. FDI cuts in 2020 jeopardize, the achievements made in the international development sector and most likely will prevent countries from meeting the Sustainable Development Goals (SDG). Hence joint efforts are needed to work out appropriate policies and improve conditions (market access, labour market conditions, availability of skilled labour force, taxation etc.) to bring back foreign investors’ contribution to sustainable development.

To stay informed about the latest global development news subscribe to the DevelopmentAid Newsletter and gain access to the latest information. You can also become a DevelopmentAid member and contribute with expertise from your own field.