The United Kingdom of Great Britain and Northern Ireland is one of the few countries in the world spending 0.7% of its national income on development projects implemented across poorer states. The UK foreign aid architecture consists of several major institutions through which the funds are funneled. In today’s article, DevelopmentAid presents one of the UK’s Development Finance Institution – the CDC Group – a Public Limited Company, entirely owned by the UK government.

CDC stands for “Colonial Development Corporation” – the oldest Development Finance Institution incorporated in 1948 with one mission – “do good without losing money”. The next year, 1949, CDC reported one of its early investments – establishing Zambia’s first Cement producing company: Chilanga cement. The factory produced most of the cement used for building the Kariba Dam.

In 1971, CDC committed to its first investment outside the Commonwealth – by providing a loan to Merpati Airlines in Indonesia.

What followed is an impressive history of assisting private businesses from developing countries raise living standards and eradicate poverty.

CDC investment portfolio

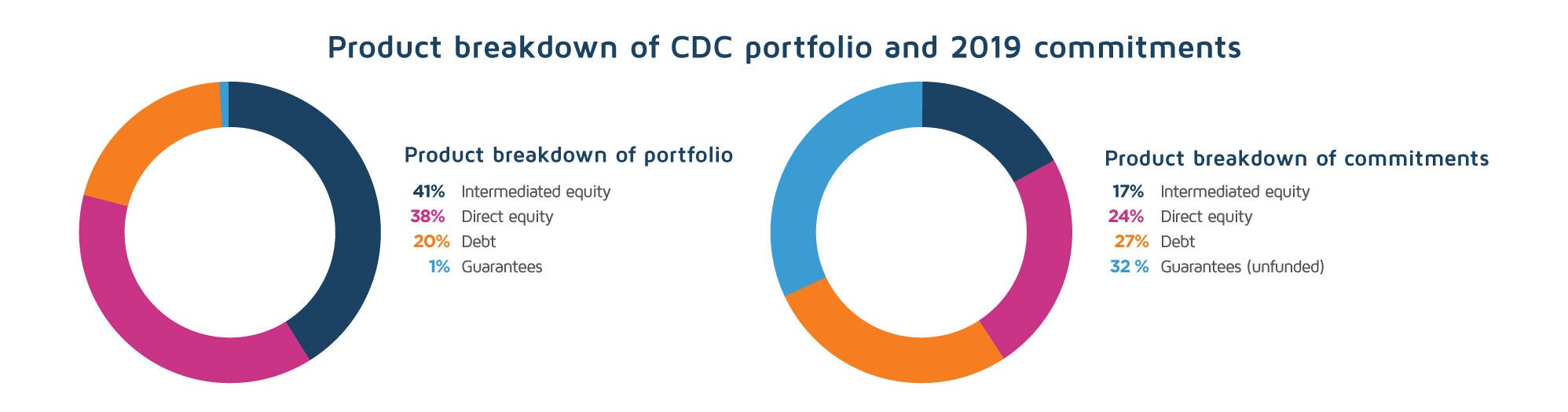

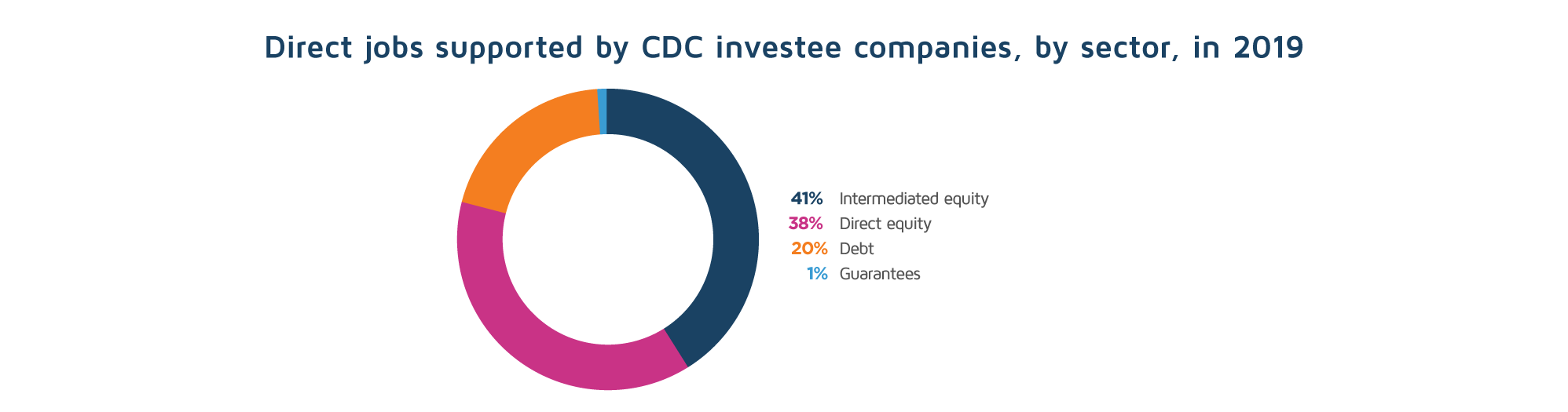

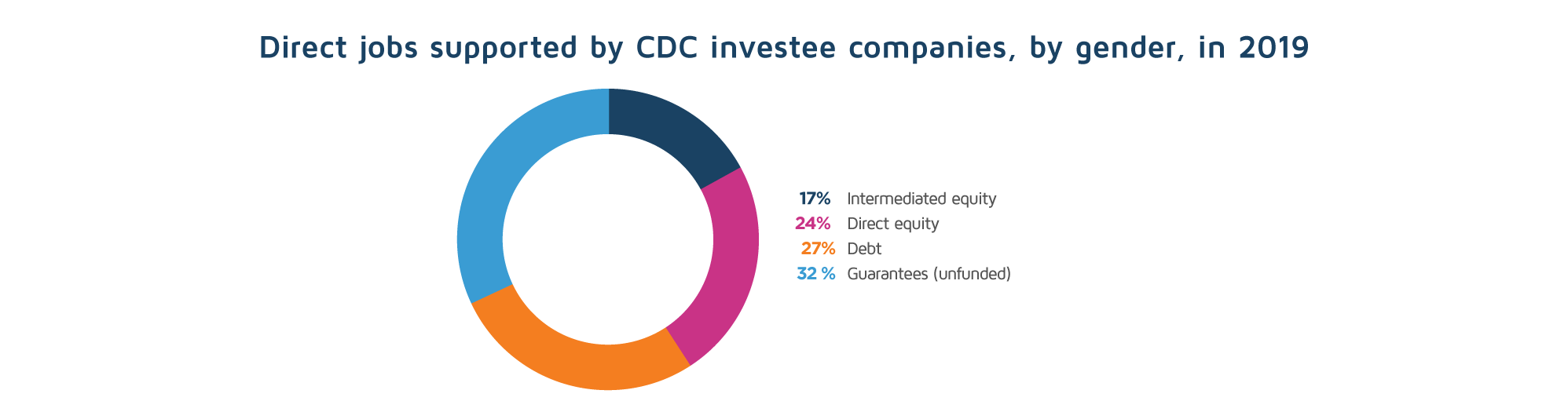

According to CDC website, the institution focuses on providing flexible long-term investment for businesses in the developing countries. The capital, so much needed by the companies in order to grow, is funneled through various financial instruments: direct equity, intermediated equity, trade finance.

Each investment is targeted to generate a financial return to the CDC Group, which allows the institution to “recycle the money” into new investments. In this way, jobs are created and taxes are paid beyond the DFI involvement.

In 2019 alone the CDC committed £1.66 billion in investments and increased its portfolio to £4.7 billion.

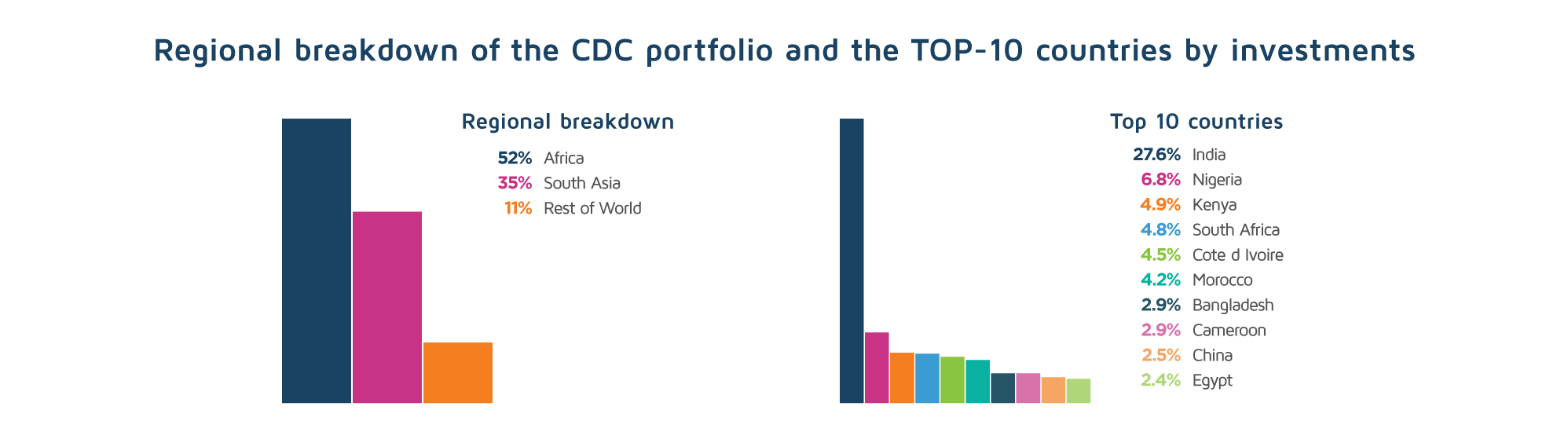

With the CDC headquartered in London, the lion’s share of CDC investment portfolio is concentrated in projects in Africa and South Asia. Moreover, since 2012, the CDC has only made new commitments in these two regions. At the end of 2019, out of 1228 businesses the group had invested in, 690 were in Africa and 377 – in the DFI’s target countries in South Asia.

Focus on decent jobs

“It’s not just any job; it’s a decent job” said Nick O’Donohoe about the CDC future plans, when joining the DFI as its CEO in June 2017.

“CDC has always been very conscientious about the way we, from a compliance perspective, ensure that when we invest in companies, they meet certain standards in terms of minimum wages, health and safety standards, avoiding any child labour and so on” he continued.

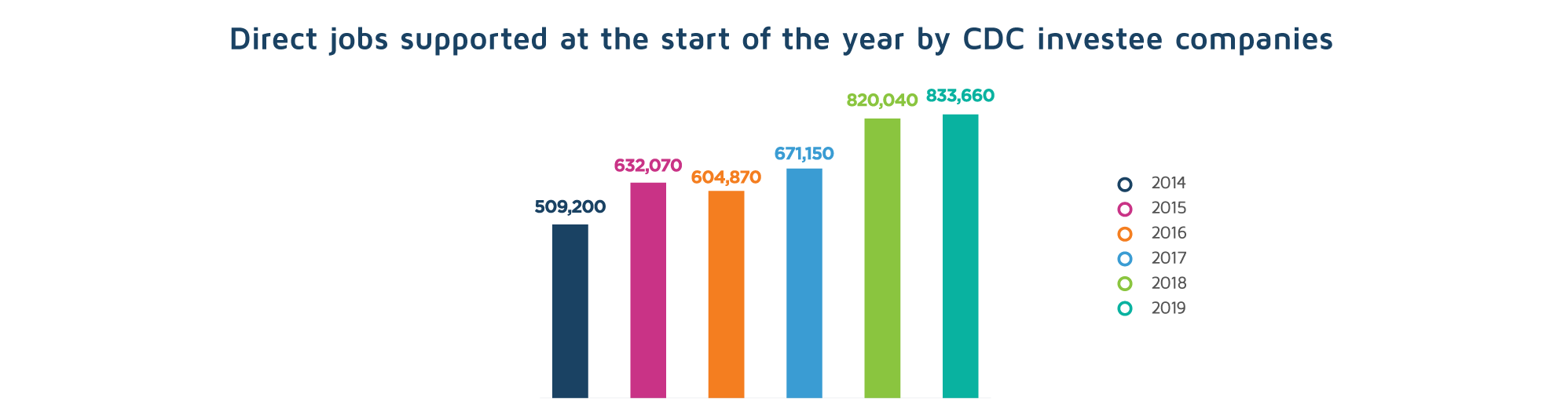

That being said, CDC has had a significant impact on the growth in the number of jobs created by the companies supported by its investments.

For example, by the end of 2019, the DFI’s portfolio of businesses in Africa and South Asia provided direct jobs for 875,790 people (in full-time equivalents). Of these workers, 42,130 were new hires in 2019.

In India – the leading country in terms of investments made by CDC – over 485,000 jobs were created. Another 30,000 jobs were created for the Bangladeshi citizens, while on the African continent, over 55,000 jobs were generated in South Africa, 37,000 in Nigeria, 28.000 in Egypt.

Main investment sectors

CDC Group provides financing to companies operating in seven priority sectors.

The Financial services sector dominates over the CDC’s portfolio sectorial breakdown with over 30% of investments provided to companies working in the financial sector. The logic behind the investments is that of supporting the development of efficient and affordable financial instruments, which are considered the main drivers of Small and Medium enterprises development, which in turn create jobs in the developing countries. Infrastructure is the second-largest sector in CDC’s portfolio, with over 28% of the £4.7 billion being invested in it. The sector with the third-largest size of the portfolio is manufacturing. Traditionally, this industry employs big groups of workers in South Asian countries, such as Bangladesh and India.

The other four sectors from CDC’s priority seven are health, food, and agriculture (agribusiness), construction and real estate, and education.

However, the group’s corporate site says that the financing institution continues to invest outside these sectors, “largely in the most challenging regions, as new investment supporting any sector helps to underpin the private sector, and create jobs and livelihoods for people”.

As previously reported by DevelopmentAid, the profit-oriented approach preferred by DFIs in their activity is strengthened by a clear theory of change. Thus, through co-participating in investment projects and offering financing to private-sector structures, DFIs can produce direct contributions – jobs, economic growth, and increased taxes. These contributions have wide developmental impacts.

So far, DevelopmentAid journalists have revealed 10 of the 17 most important DFI’s, according to the Organization for Economic Cooperation and Development.

Subscribe to our newsletter today, and stay in touch with the most important news from the development sector.