Financing green economy is a key approach to sustainability and development and is becoming of utmost importance now that the quality of life depends to a certain extent on people’s ability to mitigate environmental risks. This article considers the notion of green economy and details the contribution of the European Bank for Reconstruction and Development to promoting green finance.

Green economy/finance

The United Nations Environmental Programme (UNEP) defines green economy as an economy that aims “to improve human wellbeing and social equity while significantly reducing environmental risks and ecological scarcity”. In other words, green economy increases welfare by protecting and improving natural systems. It develops due to investments known as green finance that are intended to reduce carbon emissions and pollution and place the emphasis on energy efficiency, the sound use of resources, enhanced biodiversity, and better environmental services with a view to averting environmental and climate damage.

Multinational organizations such as the European Investment Bank, the European Bank for Reconstruction and Development (EBRD), the World Bank, and the European Union are certainly leading the way towards green finance through either old-fashioned (grants, loans) or advanced (green bonds, equity, etc.) financial tools.

EBRD’s green finance stance

EBRD, a multinational development bank created in 1991, currently operates via a network of more than 140 local institutions in over 26 countries. Back in 1994, the bank adopted a policy of financing the green economy which drove successful climate and resource efficiency investments. A decade later, the bank launched its Green Economy Transition (GET) strategy seeking to increase its green investments to 40% by 2020, a goal that it has both met and surpassed.

The bank’s Green Economy Financing Facilities (GEFFs) fund companies and household owners aiming to invest in green technologies through credit lines. According to its 2019 sustainability report, since 2006 the organization has signed €4.6 billion worth of contracts with 148 partners from 27 countries, facilitating over 190,000 sub-projects related to the green economy. This enabled an estimated 8.6 million tons of CO2 emissions to be avoided each year.

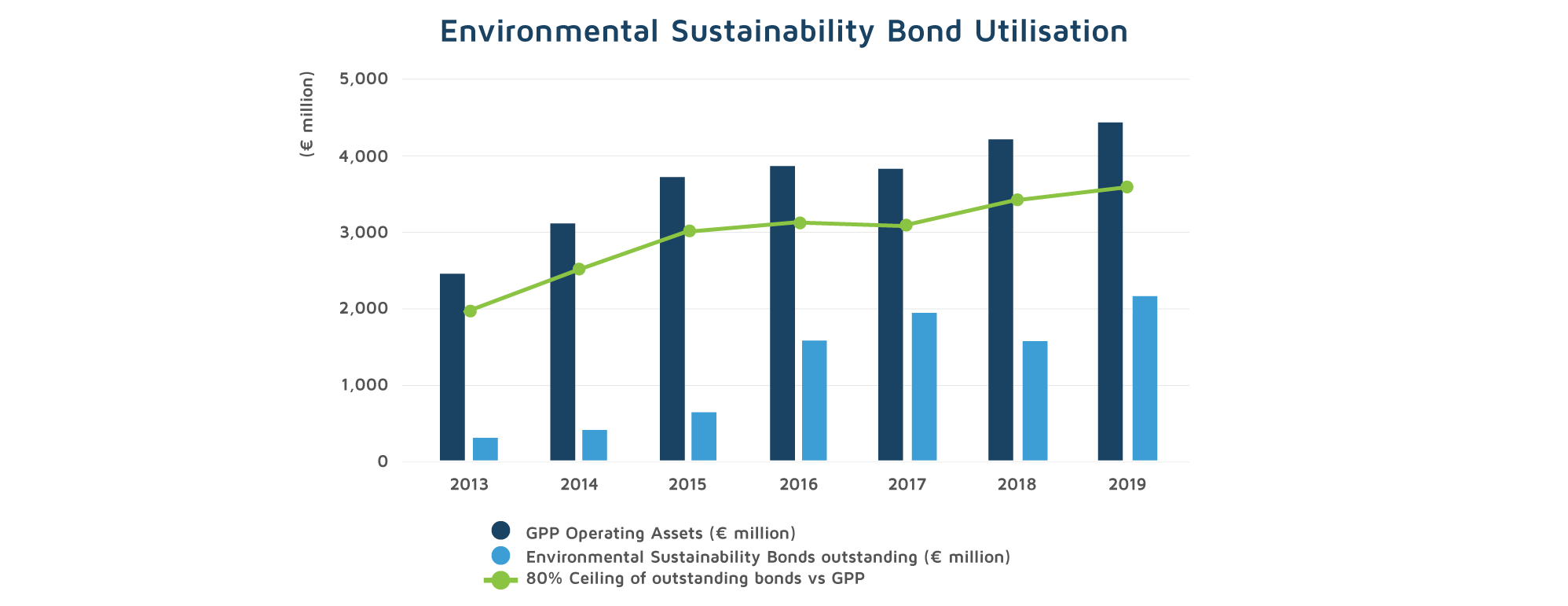

As of 2019, the bank had issued Environmental Sustainability Bonds (ESBs) amounting to €4.167 billion. The following table illustrates the yearly euro equivalent issuance.

Finance commitments

Overall, the EBRD’s GET approach covers three “pillars”: climate mitigation, climate adaptation, and other environmental benefits. As of 2019, 46% of the EBRD’s investments had helped to fund green economy projects. The bank’s green finance commitments for a number of regions and sectors for 2019 are provided in the tables below:

GEF finance commitments by regions 2019

Furthermore, in 2021 EBRD reconfirmed its objective by approving further headroom for the next phase of collaboration with the Green Climate Fund by up to US$ 497 million. Of this, US$ 373 million is planned to come from the Bank’s regular resources while up to US$ 124 million of financing will be provided by the GCF. The partnership aims to fund thousands of individual investments in know-how that decreases emissions and improves resilience to climate change. The extension of the collaboration itself is part of a US$ 1.4 billion program that spans 10 countries across three regions. It is calculated that the partnership will avoid CO2 emissions of 800,000 tons per year which is comparable to making 125 MW of coal-fired electricity production capacity redundant.