The United States of America is the largest Official Development Assistance provider in the world. The volume of ODA offered by the US in 2018 increased to almost US$ 34 billion. How and in what form the ODA reaches an aid recipient varies widely. This depends on the objective of the assistance, the type of aid program and the agency responsible for providing the aid. In today’s article of the DFI series, we present the US International Development Finance Corporation (DFC).

DFC is America’s development bank which was established in 2019 as a result of the consolidation of the Overseas Private Investment Corporation and USAID’s Development Credit Authority. As all DFIs do, DFC partners with the private sector to provide solutions for difficult challenges in the developing world.

Being a Development Finance Institution, DFC fulfills an important role in meeting the myriad of objectives via the major federal agencies through which US assistance flows. The organization provides political risk insurance to US companies investing in developing countries. Despite the seemingly low volume of investment, compared to overall US ODA, the DFC plays a crucial part in advancing American interests around the world, introducing US business standards and supporting US national security.

The DFC investment portfolio

DevelopmentAid asked the American DFI about its portfolio and investment patterns. “DFC has an active portfolio of roughly $29 billion and an investment cap of $60 billion. In addition to helping U.S. businesses to expand in emerging markets, DFC provides loans to financial institutions and intermediaries which on-lend the funds to SMEs in the developing world” explained Olivia Bell, from DFC’s Office of External Affairs.

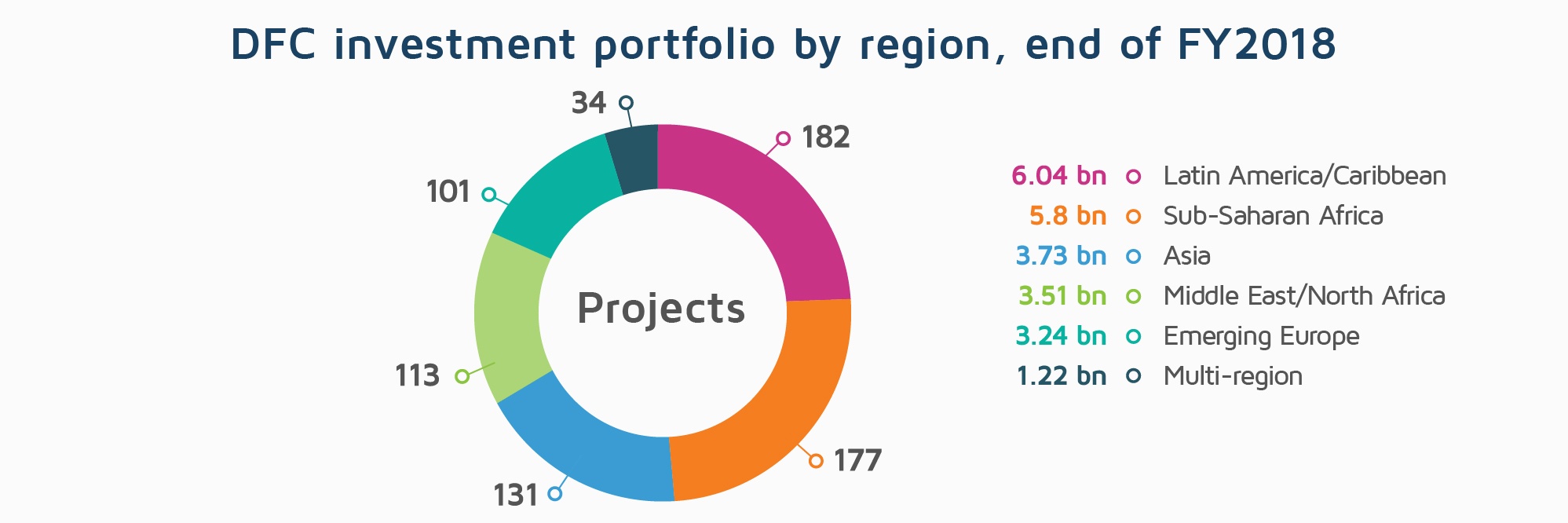

By the end of the fiscal year 2018 (FY2018), the portfolio comprised over 730 projects. Latin America and the Caribbean region benefited from the most investment projects – 182, with an approximate value of US$6 bn. Sub-Saharan Africa was the second TOP region of interest for DFC, with 177 projects and the total value reaching US$5.8 bn. Asia closes the TOP-3 regions with 131 projects worth US$3.7 bn.

“DFC expects that an additional $6.4 billion will be invested by the private sector alongside the new financing and insurance it committed in FY 2019. Sectors receiving the most support from the agency in FY 2019 included financial services, transportation, energy, oil and gas and construction” added Olivia Bell, DFC.

DFC 2020 pipeline and eligibility

In 2020, the priority areas for investment for DFC include critical infrastructure, energy, technology, healthcare and financing for small businesses and women entrepreneurs. The organization will also keep track of its traditional priority regions. Olivia Bell: “Priority regions for DFC include the Indo-Pacific, Latin America and Sub-Saharan Africa. The agency is also committed to meeting development needs in Eastern Europe as well as the Middle East and North Africa”.

In order to be eligible, a project is expected to meet several criteria. Besides fitting the DFC geography, the investor must be willing to accept sufficient exposure to the project to support its long-term viability. DFC offers debt financing in the form of direct loans and loan guarantees to support medium to long-term investments projects in emerging markets. Loans typically range from three to 15 years. Additionally, DFC requires that all the projects it supports respect the environment, workers’ rights, human rights and local communities while also encouraging a positive impact for the host country.

DFC Development Impact

DFIs across the world usually monitor and measure the ‘development’ impact of their investment projects in developing countries. Asked by DevelopmentAid to provide additional information about the DFC policies regarding development, Olivia Bell stated that “DFC vets and monitors every project based on the longstanding objectives of U.S. development, many of which appear in the SDGs.”

According to the DFC representative, the organization evaluates the developmental impact of each project across three main areas:

-

-

- Growth, i.e. contribution to economic growth through the generation of local income, fiscal benefits to the local economy, support for direct and indirect job creation and improved infrastructure.

- Innovation, i.e. innovative financial structures and business models that aim to mobilize private capital, knowledge and technology transfer and the deepening of markets.

- Inclusion, i.e. benefits to marginalized populations such as women and rural populations, underdeveloped regions and SMEs.

-

DevelopmentAid will continue its series of DFI files with a closer look at Swedfund – the Development Finance Institution from Sweden and SIFEM – the Swiss Investment Fund for Emerging Markets. You can read the previous article of the series, describing COFIDES – Spain’s public-private venture capital specialist abroad, by following this link. Become one of our members and subscribe to the newsletter to learn about the latest news and reports from the International Development Sector.