The Société de Promotion et de Participation pour la Coopération Economique – PROPARCO – is the private sector financing arm of Agence Française de Développement. This European Development Finance Institution (DFI) seeks to promote economic growth and the creation of new jobs in Africa with an emphasis on financing small and medium-sized enterprises (SMEs). The company, which operates under a banking license, gives high priority to the sub-Saharan African and Mediterranean countries. In 2019, its investment portfolio grew to include 85 new projects worth €2.5 billion. This article, as part of DevelopmentAid’s DFI Files, expands on the activity of PROPARCO and its impact.

PROPARCO was founded in 1977 as a subsidiary of Agence Française de Développement with a capital equivalent of just €1.5 million. Its mandate was mainly to finance the private sector in the Franc Zone – which brings together 14 Western and Central African countries as well as Comoros. Initially, PROPARCO had only one shareholder, Agence Française de Développement But it subsequently opened its capital to private shareholders whose number currently stands at 20. In 1990, when PROPARCO changed its status to a financial company, its portfolio stood at €9.7 million invested in 65 companies and it had a staff of 14.

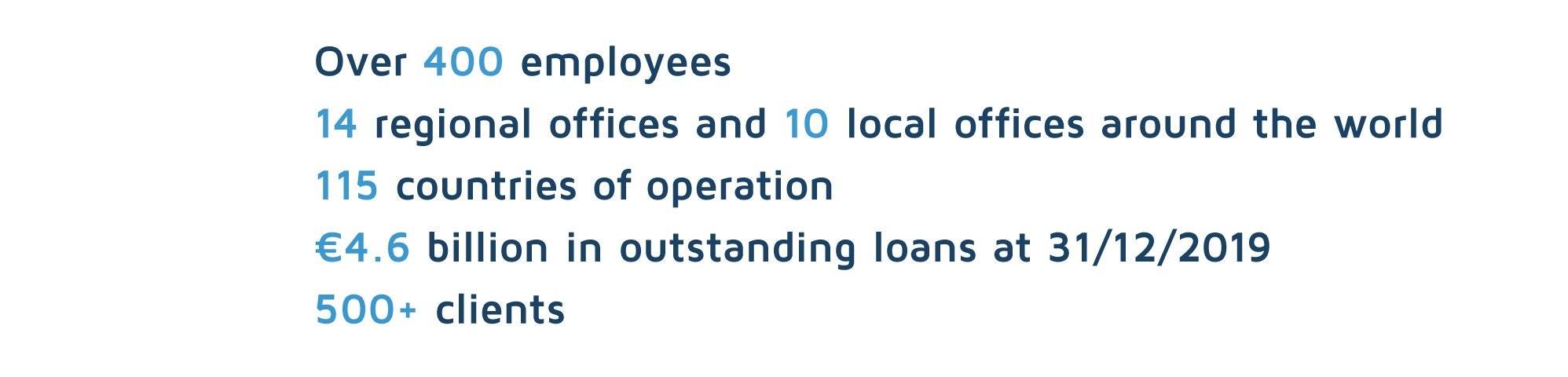

Today, the figures have changed enormously according to the company’s key figures report:

The European Development Finance Institutions Association, of which PROPARCO has been a member since 1997, stated that the French DFI has an impressive portfolio of 1,108 which, at the end of 2019, were worth €7,214 million.

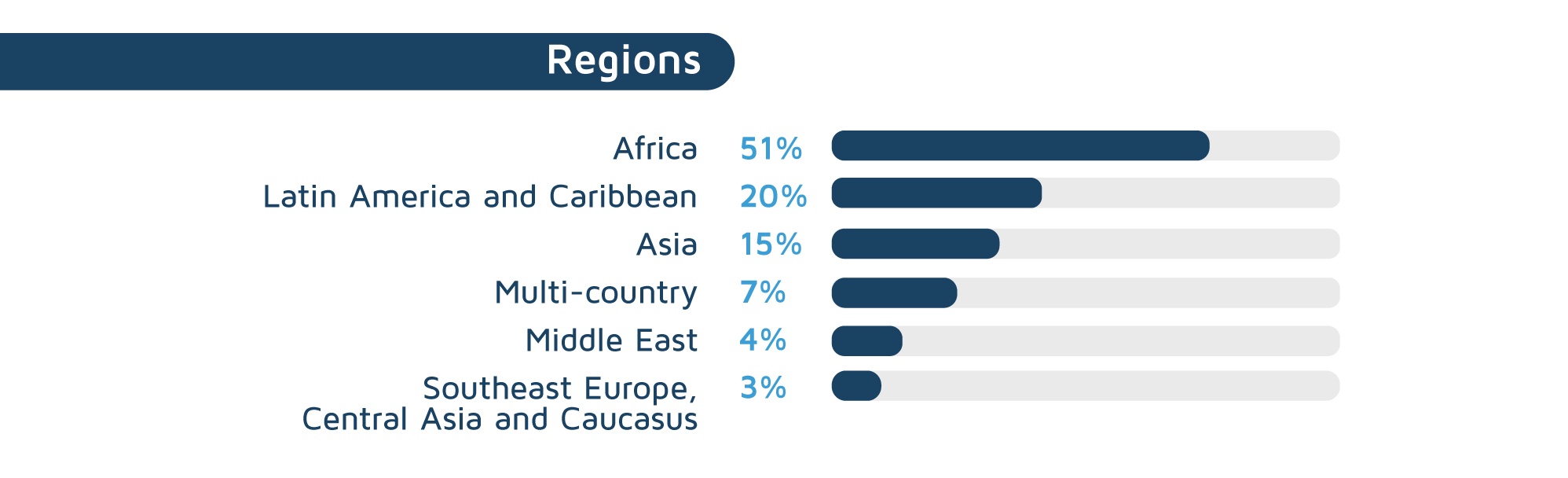

The geography of PROPARCO’s activity is vast with operations in 80 countries. At the end of 2019, Africa was the most dominant region with 51% of the company’s activities concentrated there. Key figures published by the French DFI at the end of 2019 suggest that it committed up to €1 billion to back African start-ups, micro-enterprises, and SMEs. Of this amount, €300 million was provided in equity while €700 million involved dedicated credit lines and guarantees allocated to banks to cover SME risk.

With offices in Bogota, Mexico, Santo-Domingo and Saõ Paulo, the Latin America and the Caribbean region has a 20% share in PROPARCO’s portfolio whereas private businesses in Asian developing countries benefit from 15% of the DFI’s funds.

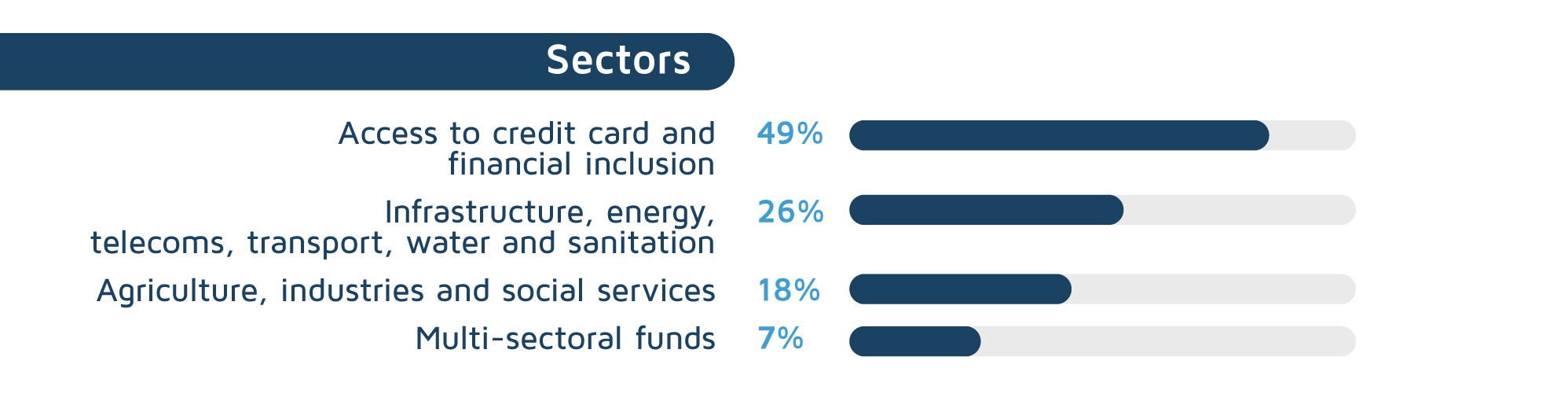

PROPARCO focuses on selected several key development areas to boost the private sector’s contribution to the achievement of the UN Sustainable Development Goals (SDGs). These areas include agriculture and agribusiness, banks, financial markets, microfinance, industry, infrastructure (energy, telecoms, transport, water, and sanitation), the manufacturing sector, healthcare, education, tourism, and real estate.

The impact of PROPARCO investments is cross-sectoral and has a direct influence on several SDGs, SDG 7 Affordable and clean energy and SDG 13 Climate action being among the priorities of the DFI. In 2019, the French development institution reported that €717 million had been committed to projects with climate benefits as a result of which over 3 billion tons of CO2 equivalent will be avoided annually due to PROPARCO investments. As soon as all its projects in the renewable energy sector are operational, the installed capacity will reach 1,896 MW (against 886 MW in 2018).

The investments committed by the French DFI will also have an impact on the SDG 8 Decent Work and Economic Growth and SDG 5 Gender Equality. Over 1.6 million direct and indirect jobs will be created or supported by 2024 with 8,300 of the direct jobs to be held by women.

PROPARCO is an important player on the international development landscape. And amid the COVID-19 pandemic, the organization has continued to support private businesses in developing countries.

In October 2020, as part of the Choose Africa initiative by AFD, which ambitiously aims to invest €2.5 billion in start-ups and SMEs in Africa by 2022, PROPARCO announced an €83 million deal in Kenya. Equity Bank, one of the leading banks in the country, is the main beneficiary of the deal, which aims to support SMEs during the econoыутуsenesemic crises triggered by the pandemic.

In another African country, Senegal, local SMEs affected by the crisis will benefit from loans guaranteed at 80% by AFD. A similar strategy is in place in Madagascar where two out of three people live in poverty, on less than one dollar per day.

At DevelopmentAid, we bring you coverage of DFIs’ activities and profiles. Become a subscriber and stay tuned to the latest news from the development sector.